As one of the leading cryptocurrencies, Solana has undergone impressive development, especially considering the challenges the market presented in 2022. This article provides a comprehensive overview of the latest developments in the Solana ecosystem that are important to investors and crypto enthusiasts.

(SOL)

Click here to Buy Solana

Solana Update December 2023: A Look at the Ecosystem at $60

After the challenges of 2022, which affected many cryptocurrencies, Solana showed remarkable resilience. The ecosystem experienced a revival of its token value and an increase in on-chain activities as well as growth in the DeFi sector. SOL is currently trading at a price of $62, which represents an increase of 153.17% in the last 30 days. This indicates a robust structure and strong potential from Solana, even in volatile markets.

Solana’s Uniqueness and Revenue Sources

Solana stands out due to its high performance and extremely low transaction costs, which makes it particularly attractive for industries such as payment processing, gaming and social media. Solana’s revenue sources include transaction fees and shares from the integration of Solana Pay with other platforms. A notable development is VISA’s decision to use the Solana network for processing USDC transactions, which is expected to increase network revenue through transaction fees.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

Key developments in the Solana ecosystem include:

– FireDancer: The introduction of the FireDancer validation client is a significant step towards strengthening the Solana architecture. This upgrade aims to increase the available block space capacity and directly addresses the scalability requirements of a leading blockchain platform.

– JITO Collaboration for MEV Efficiency: Solana is working with JITO to optimize the extraction of Maximum Extractable Value (MEV). This partnership is intended to reduce block spam and increase validator revenue, underscoring Solana’s commitment to network efficiency and profitability.

Solana technology relies on innovations and strategic partnerships to strengthen its position in the cryptocurrency market. With its user focus and continuous technical improvements, Solana is positioning itself as a promising player in the crypto world. In the following sections, we will further examine Solana’s strategic partnerships, user orientation and future roadmap.

Solana in December 2023: Driving Forces and Strategic SOL Partnerships

One of the main elements behind Solana’s impressive rally is the innovation in the staking area. Of particular note is the strong demand in the on-chain area, which was made clear by innovations in Solana staking. The introduction of Liquid Staking, enabled by platforms such as Marinade Finance, JPool and MarginFi Lending, has revived interest in $SOL, especially in the area of Liquid Staking.

Currently, over 71% of $SOL is staked, making Solana the second largest PoS blockchain (Proof of Stake) by market capitalization in the staking sector after Ethereum. This high percentage of staked $SOL not only reflects investor confidence, but also contributes to the scarcity effect that drives the price up. Solana offers its stakers and validators incentives that exceed the annual inflation rate. The current annual yield (APY) for staking SOL is 7.7%.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

Solana’s Strategic Partnerships Expand Horizons

Solana has entered into significant partnerships with technology giants such as AWS Cloud, Google Cloud Tech and Visa. These collaborations are more than just business collaborations; they are confirmations of Solana’s potential in the broader financial ecosystem. They could be crucial in bridging the gap between traditional finance and decentralized financing (DeFi) and opening up new avenues for institutional investment.

Transaction Fees and Solana Pay

Solana generates revenue from transaction fees and through revenue sharing from integrations of Solana Pay with other platforms. This diversified revenue model not only supports the platform’s financial stability, but also promotes integration within the broader ecosystem.

Solana Partnership with Payment Provider Visa

Visa’s recently announced use of Solana for processing USDC transactions is a significant recognition. This collaboration could significantly increase Solana’s network revenue through transaction fees and strengthen its market position.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

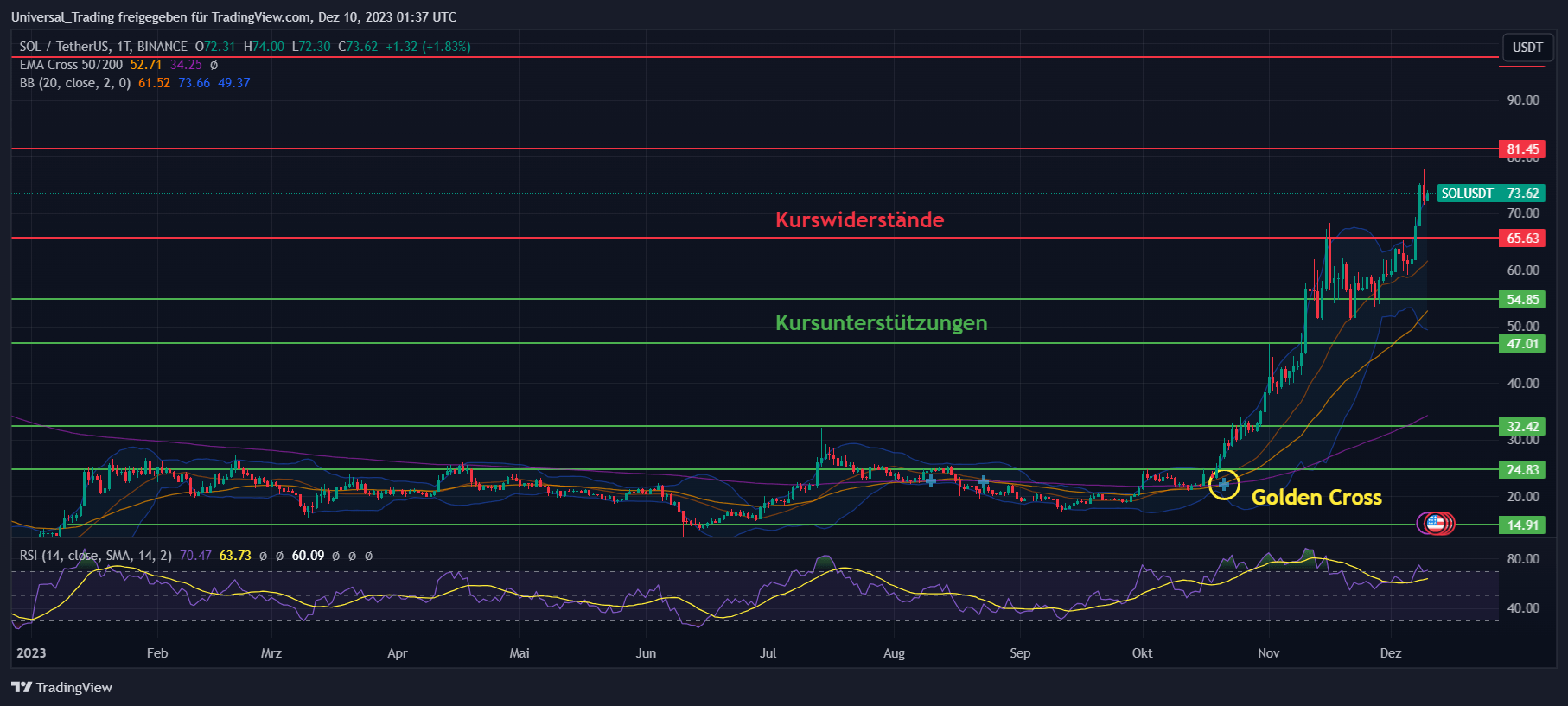

Solana Price Analysis: How Long Will It Take for the SOL Price to Break Through $100?

The recent developments in the price history of Solana (SOL) have clearly stood out from other cryptocurrencies. Since the second half of the year, the SOL Coin has shown an impressive performance and more than doubled its value. With a current price of $32.19, Solana exceeds the psychologically important mark of $30, which is often regarded as a critical support line.

What is remarkable about this development is the continued stability of the Solana price in recent days. This consistency suggests that the rise in the SOL price is not just a short-term trend, but represents a sustainable increase in value. In the often volatile crypto world, this is a strong sign of Solana’s robustness and future potential.

An additional positive sign is the appearance of a “Golden Cross”. This technical pattern occurs when a short-term average crosses the long-term average from bottom to top. In technical analysis, this is often seen as a bullish signal, which could mean a continuation of the upward trend for Solana.

For the future price development of Solana, it is crucial to defend the $30 mark. Technical indicators such as the Relative Strength Index (RSI) and the Bollinger Bands, which should show a cooling in SOL, are also important. Although the Solana price is currently in an oversold area, the trend indicates a normalization.

A key feature of Solana is its focus on the user experience. With extremely low transaction fees and impressive transaction speed (currently 4800 TPS), Solana is not only aimed at the existing crypto community, but also lowers the barriers to entry for new users.

Conclusion on the Fundamentals of Solana and the Forecast of the SOL Price

Looking to the future, Solana seems poised for further growth. With plans to improve its technology stack and deepen its presence in new financial models, the platform is preparing to maintain its position at the forefront of blockchain innovation.

Solana’s current situation paints a promising picture for the ecosystem and its investors. The recent developments and the recovery of the token value signal a strong position in a constantly changing crypto market. In the next part, we will delve deeper into the core areas of Solana’s growth and innovation.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch