The Ethereum blockchain has made changes throughout the year to improve its functionalities and gain greater community support. In September 2022, the Merge was introduced, laying the foundation for further ETH upgrades. The next major improvement to the network is the Shanghai Ethereum Upgrade, which is scheduled for March 2023.

Background of the Shanghai Update

In early 2022, Vitalik Buterin presented a plan to improve the Ethereum blockchain to overcome underlying challenges such as high energy consumption, scalability issues, and exorbitant transaction costs.

As early as September 2022, Ethereum updated its network through the Merge, which switched the blockchain from the Proof-of-Work consensus mechanism to the Proof-of-Stake mechanism. This upgrade reduced energy consumption by over 90%, attracting many investors.

However, the Ethereum Merge was just one of the essential upgrades to increase the network’s scalability, efficiency, and cost-effectiveness. One of the highly anticipated Ethereum upgrades to increase the network’s performance and increase its acceptance is the Shanghai upgrade. Investors expect that after its introduction, the Ethereum blockchain can be used for more purposes and drive the ETH price up.

According to the information available, after the 151 Core Developers Ethereum Meeting, which took place on December 8, 2022, the next Ethereum Hard Fork, the so-called Shanghai Upgrade, will take place in March 2023.

The Shandong Testnet

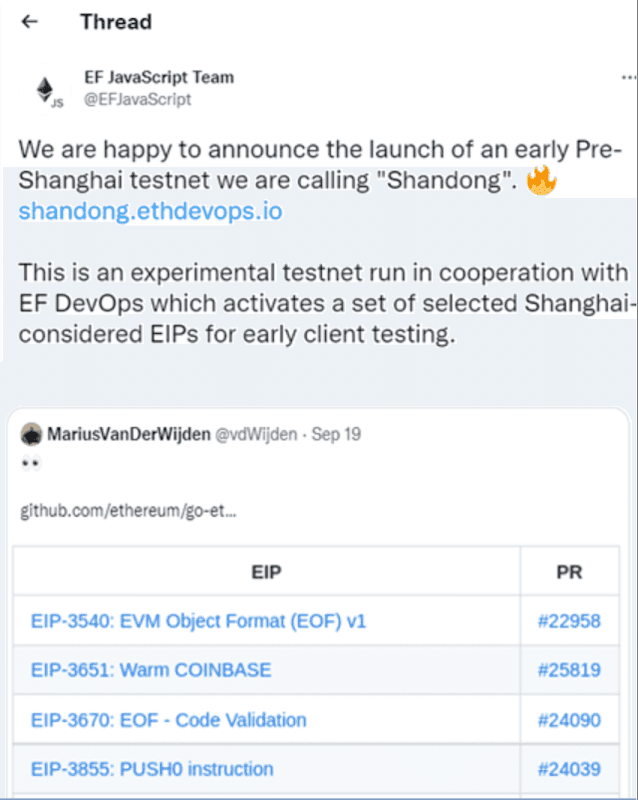

The launch of the Shandong Testnet on October 18, 2022, confirmed the progress that the developers have made with regard to the launch of the Shanghai Ethereum Upgrade. The Ethereum Foundation JavaScript Team shared this information on Twitter, giving the Ethereum community hope.

Shandong allows developers to experiment with the Shanghai upgrade before it comes onto the market. In this way, the team can test the potential of the EIPs and solve problems.

Scalability is at the Heart of the Shanghai ETH Upgrade

As mentioned earlier, the Shanghai update will solve several problems that the network is currently facing. However, the main goal is to solve the scalability problem that the network is facing. The team wants to increase the blockchain’s ability to handle high transaction volumes that arise from the introduction of various decentralized applications (dApps) on its infrastructure.

The network’s ability to process a larger number of transactions will lead to higher demand for its products and Ether (ETH). Unfortunately, its current inability to process a larger transaction volume leads to lower speed and higher transaction fees.

Basically, the Shanghai upgrade will introduce Danksharding, which increases the number of transactions that are processed within a period of, for example, 1 second. With Danksharding, the network increases the blob spaces of the data instead of dividing the network into shards.

Structurally, the network will verify large amounts of transactions after retrieving a few data. Another advantage of dank sharding is that it supports many Layer-2 protocols that bundle transactions before forwarding them to the Ethereum blockchain. For example, oracles such as Chainlink and roll-up protocols such as Arbitrum are supported.

The result is a cheaper and faster network. Ethereum will introduce Proto-dank sharding improvement proposal 4844 (EIP-4844), which was written by Dankrad Feist and Ethereum co-founder Vitalik Buterin.

Shanghai Will Include Several Secondary Upgrades

In addition to the introduction of shards, the Shanghai update will implement several Ethereum Improvement Proposals (EIPs), such as WARM Coinbase (EIP-3651), EVM object format (EIP-3540), and the revision of the Ethereum Virtual Machine Format code (EIP-4844).

Implementation of the EIP-4895 Proposal

The Shanghai Ethereum Upgrade will include the implementation of the EIP-4895 proposal, which will allow investors who have invested ETH in the Ethereum 2.0 contract to withdraw and pay out their stakes.

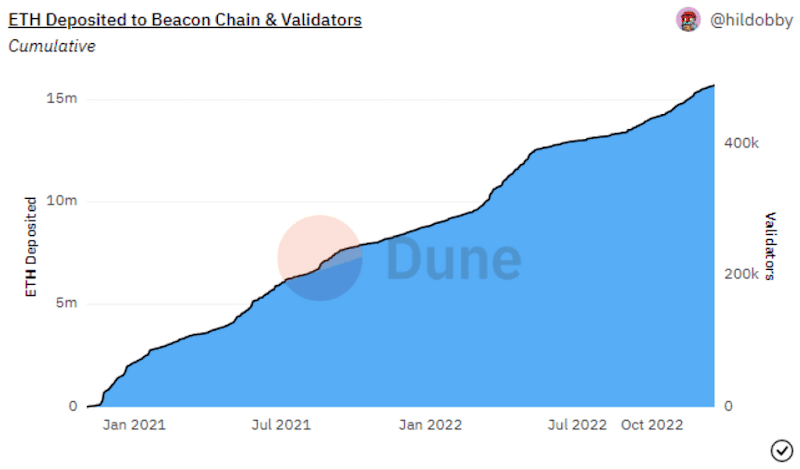

Since 2020, many investors have used their ETH to participate in the PoS validation process. Nevertheless, they cannot have their staked ETH paid out until the EIP-4895 proposal is implemented. Currently, investors have staked a total of more than 15.5 million ETH with a value of more than 19 billion US dollars.

As you can see from the graphic, more than 15.5 million ETH are staked in Ethereum 2.0.

EVM Object Format (EOF)

With the Shanghai update, the EVM object format (EIP-3540) will be introduced, which will bring elementary changes to the EVM functions of the blockchain. By the way, the Ethereum Virtual Machine format is “the execution environment that provides smart contracts on Ethereum.”

The changes to the EVM include separating the data from the code, which will help reduce the gas for contract development. In addition, the developers will introduce a new contract code that will allow the system to solve complex functions such as account abstraction and control flow in EVM. Once the team has implemented the above changes, it will be easy to make further improvements to the EVM in the future.

The Shanghai Hard Fork will allow developers to make changes to the COINBASE addresses. In fact, the address will be called “WARM” instead of “COLD” to reduce the gas fees paid to the developers. This will also allow the network validators to collect transaction fees when validating the blocks.

As we know, the builders are one of the most important participants in the network, as they organize transactions in a specific order before forwarding them to the validators for inclusion in the blockchain. Currently, traders pay high transaction fees to the builders so that their transactions are confirmed quickly. Therefore, there will be a reduction in these fees after the introduction of WARM Coinbase (EIP-3651).

How the Shanghai Ethereum Upgrade Affects ETH Staking

The success of the Shanghai upgrade means that many investors will be able to withdraw ETH from Ethereum 2.0. Depending on the reaction of users after the upgrade and if many investors withdraw their ETH, we could see an increase in the circulating supply and trading volume on the exchanges.

However, the decline in staked ETH also depends on its market price and the prevailing investor mentality. If the price rises, many investors will probably release and sell their ETH. However, if the realized price is higher than the market value, the trading volume can be low and the amount of staked ETH can remain high.

How the Shanghai Upgrade Can Affect the ETH Price

The upgrade can affect the ETH price in both directions. It can rise or fall, depending on the market dynamics at that time. There is a possibility that the ETH upgrade will lead to higher sales pressure if many investors dissolve their stakes and sell their ETH. This is possible in view of the fact that more than 15.5 million ETH are staked.

There are other factors that can cause ETH to rise sharply after the Ethereum Shanghai Fork date. First, the upgrade will lead to fast transactions and lower gas fees in the Ethereum network. Secondly, the processing of ETH transactions on Layer-Two blockchains such as Arbitrum and Optimism will become easier, which can lead to a higher acceptance of ETH. At the moment, however, the trading price of Ethereum is moving around $1,666, as can be seen on the Gate.io cryptocurrency exchange, after breaking through the breakout point of $1,650. The change in the price trend after the upgrade must be combined with the real time at that time again

These factors, as well as the growing confidence in the blockchain, could trigger a sharp increase in the ETH price.

Conclusion

According to the developers, the Shanghai Upgrade Ethereum will take place in March 2023. They will implement several Ethereum Improvement Proposals (EIPs) such as WARM Coinbase (EIP-3651) and EVM object format (EIP-3540). The benefits of the upgrade include faster transactions and lower gas fees. In addition, investors expect an increase in the Ethereum price.