In 2021, the Bitcoin price adjusted to the price developments on the regular stock markets. It was also the year of the institutionalization of the leading cryptocurrency. The best-known examples of the largest corporate investors in Bitcoin (BTC) are probably MicroStrategy and Tesla. Among noteworthy crypto holders, however, there are also more and more governments as well as ETF providers, which together hold a large share of Bitcoins.

MicroStrategy Has the Largest BTC Holdings

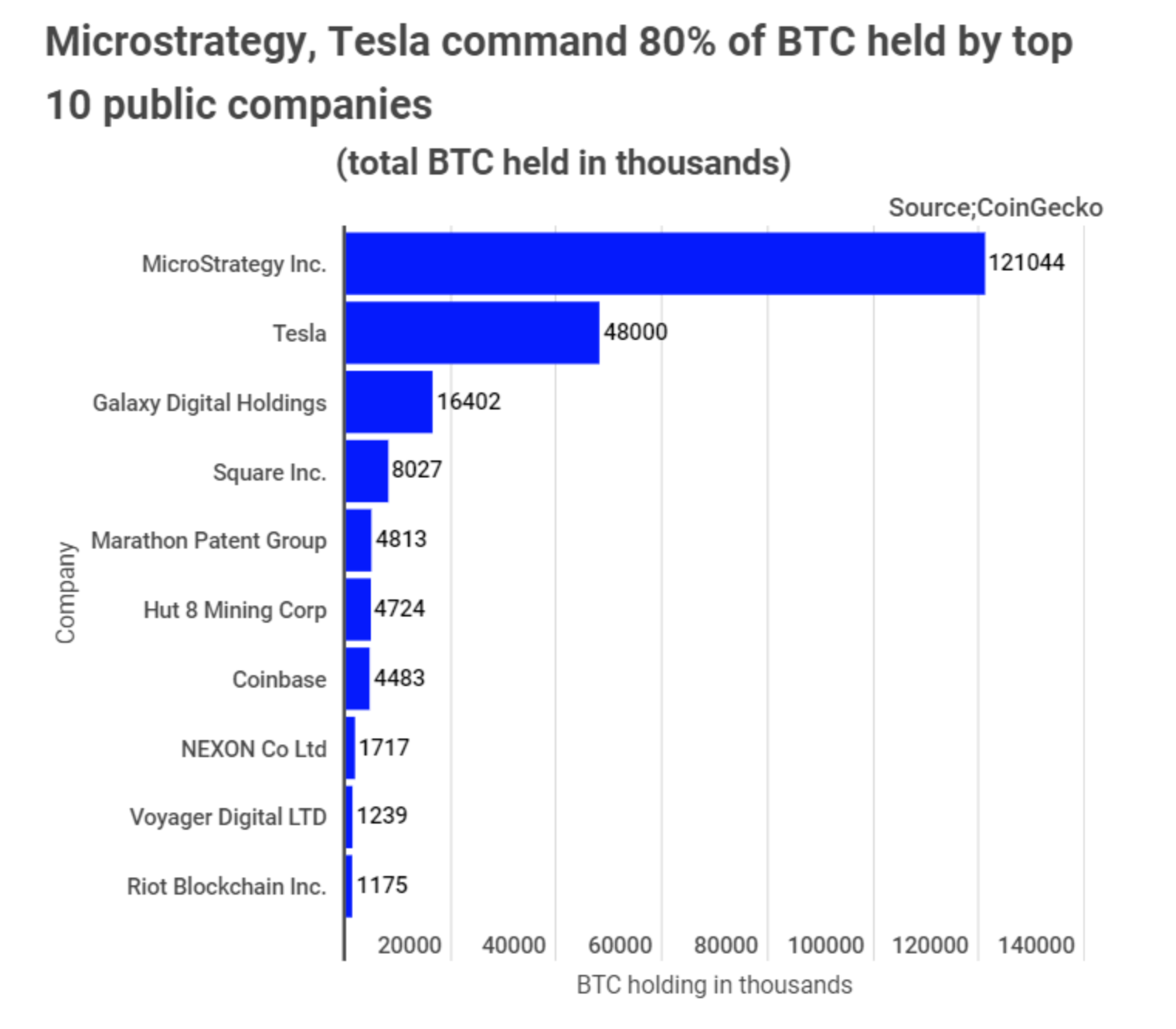

Institutional investors currently hoard 7.2% of total BTC holdings; of which private companies hold the smallest share, while the largest share is attributable to exchange-traded funds. Meanwhile, Bitcoin has been added to the balance sheets of more than 40 listed and private companies. The software manufacturer MicroStrategy, led by CEO Michael Saylor, is and will likely remain the company with by far the largest Bitcoin holdings for a while. Here, of course, we are talking about officially known data.

Currently, MicroStrategy holds around 124,400 Bitcoins, which are currently worth around €4.6 billion. The fact that the company itself is worth €4.9 billion on the stock exchange gives an even better insight into the fact that its Bitcoin holdings make up the essential part of the company’s capital.

Related: MicroStrategy pays board members with Bitcoin instead of cash

The number of companies that have included cryptocurrencies in their balance sheets has generally increased. More and more listed companies are using this strategy to get involved in Bitcoins on the stock markets and hedge against inflation. Exchange-traded funds are still popular with BTC buyers, as they enable better diversification.

After MicroStrategy, Tesla, with 48,000 BTC, is considered another company with the largest Bitcoin holdings. Behind them are Galaxy Digital Holdings with 16,402 BTC, Block (Square) with 8,027 BTC, Marathon Patent Group with 4,813 BTC, Hut 8 Mining Corp with 4,724 BTC, Coinbase with 4,483 BTC, NEXON Co Ltd. with 1,717 BTC, Voyager Digital Ltd. with 1,239 BTC and Riot Blockchain Inc. with 1,175 BTC.

Bulgaria Has more Bitcoins than El Salvador

For some, it may be surprising that El Salvador is not the country with the highest Bitcoin holdings, but Bulgaria. In 2017, the law enforcement authorities of the small Eastern European country confiscated over 200,000 BTC from cyber criminals. Bulgaria even holds more than 1% of all Bitcoins in circulation.

However, what exactly happened to these crypto holdings worth billions has been unclear ever since. Whether the state can access the confiscated Bitcoins is more than questionable, because according to observers, the Bulgarian authorities most likely do not have the necessary keys.

International Monetary Fund (IMF) warns El Salvador of the risks of Bitcoin

In contrast, El Salvador – the first country in which the cryptocurrency was officially recognized – bought around 1,800 BTC in 2021. Ukraine, Finland and Georgia are other countries with significant Bitcoin holdings.

USA’s BTC Holdings are Worth more than the GDP of some Countries Combined

In recent years, the United States has seized and auctioned off over 185,000 BTC. The value of these crypto holdings corresponds to the GDP of the Maldives, Seychelles and Bhutan combined. Over the years, the USA has confiscated Bitcoins worth several billion € and auctioned them off below their actual value. In August 2021, the USA still held a value of over €1 billion in Bitcoin.

The United States government gets its Bitcoins and other digital assets from covert operations. One such operation was carried out against the Silk Road marketplace and resulted in a seizure of several thousand Bitcoins. With the help of the blockchain analysis company Chainalysis, undiscovered transactions were identified that led to the Silk Road, a marketplace in the Dark Web, where digital currencies were used to trade drugs and weapons, among other things. Ross Ulbricht, the creator of this marketplace, was sentenced to life imprisonment in 2015.

Connected: Bitcoin usage in the Darknet continues to rise

The USA has developed effective tools for combating crime in order to track and confiscate cryptocurrencies when they have been used for criminal activities. These are then auctioned off and the proceeds from the crypto sales are used to finance various operations.

Despite strong regulation, the USA is relatively crypto-friendly, while more and more countries around the world are restricting or even making the use of cryptocurrencies impossible with bans and measures. The most recent ban comes from Singapore, where the state is taking action against crypto ATMs, while last week the Russian central bank also demanded a crypto ban. These are just some of the many reasons for the current crash on the crypto market, which will probably be followed by a long recovery phase.

More Bitcoin News