A key point of any blockchain is its scalability. In other words, the processing of transactions. The various approaches of the Proof of Work method on the one hand and the Proof of Stake method on the other have recently occupied the crypto community, especially due to the start of ETH 2.0 format. The gradual switch to the new “Beacon” blockchain will in future lead to the use of the Proof-of-Work (PoW) consensus mechanism to the Proof of Stake (PoS) method mentioned above. Reason enough to ask the question: What are the actual differences between Proof of Work and Proof of Stake?

Proof of Work and Proof of Stake: Different Creation of New Blocks in the “Chain”

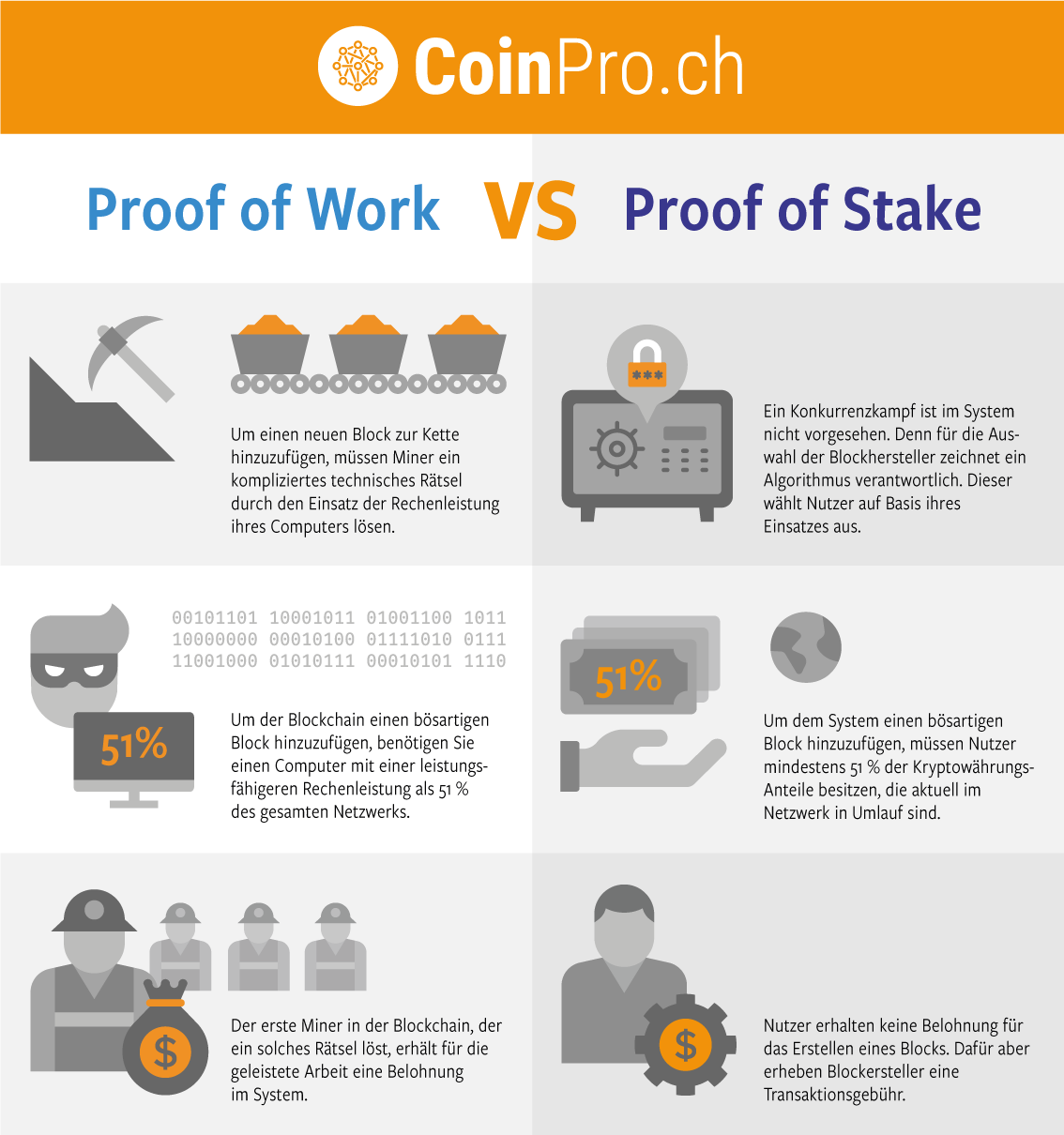

There are significant deviations between the procedures when it comes to adding more blocks to the blockchain. Proof of Work protocols such as Bitcoin, Litecoin and (so far) Ethereum work with a process that is as complex as it is energy-intensive when releasing blocks. Complex computing tasks have to be solved here, which are also associated with quite high costs. The task is solved by the miners in the network. The demands on computing power are considerable. The competition between miners for the distribution of tasks is leveraged in the Proof of Stake process by the system independently determining the manufacturers of the blocks.

Blocks are created by the share of the currency held by currency owners in wallets (digital wallets). These are “staked”, which means unlocked. Currency owners secure the system by confirming (validating) transactions with their currency holdings. While PoW miners receive rewards for block creation, PoS rewards are given via an interest system, so to speak. The amount of “interest” varies depending on the system. The more shares investors hold, the higher the validated transaction volume can be. PoS blockchains therefore do not rely on mining new coins when it comes to distributing rewards. Here, transaction fees are offered to the block manufacturers as compensation for their confirmation services.

Lower Energy Consumption and Hardware Costs

Proof-of-Stake (PoS) protocols are characterized, among other things, by the fact that network users can participate in the processes with less expensive hardware. Proof of Work systems often require the use of costly mining equipment. Regarding costs, the aspect of energy consumption during block generation is also important. PoS systems are characterized by lower consumption when operating uniform databases. From an environmental protection point of view, Prook-of-Stake is therefore considered advantageous by many supporters. Proof of Work methods work faster with regard to synchronization between the various network nodes.

The Distribution of Rewards in the System

As the graphic shows, with Proof-of-Work, those miners whose system takes over the completion of the next block in the chain receive a reward. Miners in the PoS system, on the other hand, are selected at random – every operator of a node has the chance of receiving the reward. However: The basic prerequisite for being selected as a miner is that operators have a certain specified amount of the coins/tokens used in the network in their wallet. POS “rewards” are also awarded if node operators validate transactions, i.e. confirm them through the appropriate technical check.

Risk of “Hostile Takeover” Weighted Differently in PoW and PoS Systems

The term 51 percent attack appeared in many reports about potential risks in blockchains, especially in the early years of crypto development. This is about the conditions under which, for example, hackers or miners who primarily pursue their own interests can take over a blockchain network and thus influence the circumstances. In systems that work according to the PoW method, malicious blocks can be integrated into the chain if individual network participants alone have more than 51 percent of the total computing power of the system. There are many so-called mining farms in China in particular, which often individually carry a large share of the blockchain performance (not only with Bitcoin). The risk of an attack is therefore quite high in PoW networks.

Within blockchains with PoS protocols, a share of at least 51 percent of the currency units that are in circulation at the moment of the attack is required. Although this is conceivable with some (especially smaller blockchains). Even with larger systems, large investors are increasingly having huge holdings of related currencies. Nevertheless, malicious attacks are less likely, as currency shares are usually distributed among many investors in practice.