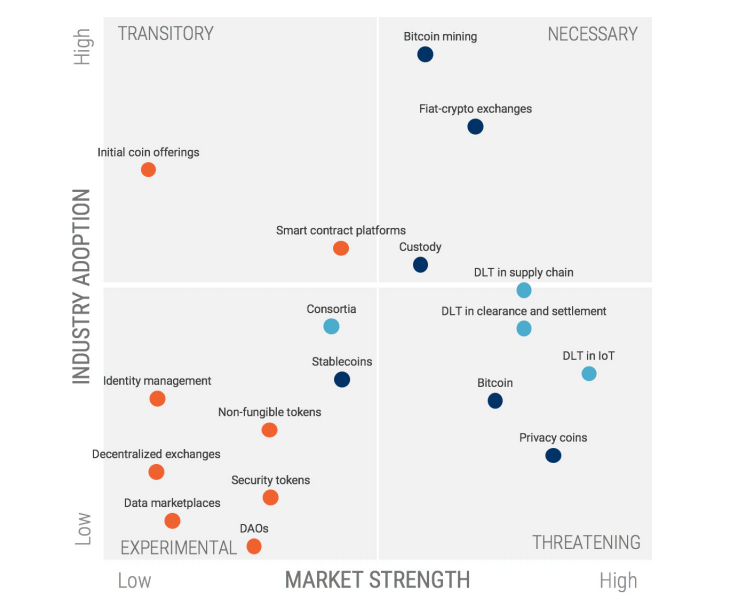

As a rapidly growing industry, the blockchain sector is characterized by regular new trends and innovations. The past few years have shown the potential of blockchain and currencies such as Bitcoin or Litecoin commercially, but also privately. More efficient transaction processing with a lower cost level at the same time – this is one of the hopes that companies have been placing in the blockchain for several years. A new report by the experts at CB Insights under the headline “What’s Next In Blockchain 2019?” is dedicated to the latest blockchain trends in 2019. Topics include the recently somewhat forgotten Bitcoin Mining and the much-discussed Security Token. Cybersecurity, which is increasingly relevant for banks, is also addressed. The trend analysis is based on “NexTT frameworks.” The experts classify trends into four categories. According to the report, they are either “necessary“, “experimental“, “threatening” or only “temporary“.

Important when reading: The naming of the trend areas should not be taken too literally. Rather, it seems that everything needs a name.

Trends of a Necessary Nature – Challenges for Blockchain Companies

The experts consider, for example, the reorientation of crypto service providers such as exchanges to be necessary. They need to explore new use cases to generate customers and thus capital. Cooperations with other industries, expansions of the currency portfolio or newly developed assets are three possible approaches. Banks, in turn, need to work on new deposit structures in order to enable customers to safely store digital currencies in the future. In the area of mining, the two refer to two essential trend points. Large miners such as Bitfury must take into account that an increasing demand will prevail on the market in parallel with a decreasing demand. According to the report, a bridge to the field of artificial intelligence could be an opportunity.

Many Experimental Trends could Soon Prevail

In the experimental trends section, for example, developments that are still in their infancy or even in the conceptual phase can be found. At this point, the report mentions the decentralized data and resource exchange. A keyword may be the “smart contracts” that many users know from the Ethereum system. The report assigns contract conclusions without intermediaries (notaries, lawyers, brokers) to the experimental trends. Cybersecurity in the sense of the applicable “Know-Your-Costumer” (KYC) and international anti-money laundering laws can also be found by readers in this category as a basis for the development work of decentralized exchanges.

The report firmly expects that such a decentralized exchange will succeed with the hoped-for success in the foreseeable future. The report also sees blockchain consortia as “still experimental”. Soon, however, the cooperations could solve existing problems in many ways and integrate the blockchain into new areas. The technology could also gain greater acceptance more quickly through the mergers. Also in the experimentation phase: stablecoins, i.e. security tokens. Innovative, but still at the beginning, are also blockchain companies without a clear owner and DAOs, the so-called decentralized autonomous organizations.

Threatening Blockchain Trends – Internet of Things and DLT

At least so far, the report sees billing systems based on blockchain and blockchain or Distributed Ledger Technology (DLT) as one of several “threatening” trends in the market. Progress in the field of “Internet of Things” (IoT) as well as the development work at companies that attribute a future main role to both technical approaches in payment transactions and the transparent design of their supply chains could achieve a reassessment. Especially providers like IOTA provide better PR here. For example, through cooperation with car manufacturers and well-known fashion labels. More and more is happening in terms of security. The classification of Bitcoin as a threatening trend is interesting. The reason for the assessment is understandable. Although the currency offers enormous profit potential, there are still few application opportunities in “real” life. Here, by the way, readers also encounter privacy coins such as Monero or Dash. These still have the image of a DarkNet currency. However, the acceptance of normal Internet users is increasing slowly but surely.

Temporary Trends – between Success and Failure

Last but not least: the “temporary trends”. This is about the question of whether trends can establish themselves permanently or whether they will soon disappear from the market again. The report mentions ICOs primarily because of increasingly strict regulation and a number of national bans. Ethereum and comparable “intelligent” platforms for digital contract conclusions are equally seen by the report in this fourth trend category. Regardless of which trends currently belong to which report category: A change to another category in the next report from CB Insights is, in the truest sense of the word, not categorically excluded.