Over time, each cryptocurrency project shows the market whether it is capable of developing disruptive potential or whether it is more likely to fail due to an overly ambitious roadmap or lack of innovation. In worse cases, projects are abandoned when the industry experiences a difficult phase or a downward trend.

In other cases, it takes years for the utility of a token to properly develop, so that time is instead used entirely for the value and perspective it offers. The result of such situations is, for example, a coin like Covesting (COV), which started towards the end of the last bull market and has since developed very well due to the active and reputable team behind the project.

The example is all the more remarkable when you consider that there are new projects in the crypto world every day. This also shows a deeper insight into the complete development of the native COV utility token from its early beginnings to its current state. And a look into the future also shows what further developments are planned around the token.

Past: Introduction of COV Tokens and Introduction of Copy Trading in Crypto

The COV token was launched as an Initial Coin Offering as early as the end of 2017. The special feature of the utility token was that a native copy trading module was integrated. The plan for the copy trading module was ambitious and was intended to connect followers with strategy managers and build a global leaderboard system.

The token sale was almost immediately sold out, which underlined the demand for cryptocurrencies with real innovations at that time. Within months, Bitcoin and Ethereum suffered a dramatic setback, dragging the market down and slowing down innovative projects throughout the space. Interest in all projects noticeably declined during this time.

Covesting, a European-based fintech software developer, sought and obtained one of the first DLT licenses at that time. The license restricted certain business models that were critical to the copy trading experience. As an alternative solution, the company decided to develop its copy trading software as a third-party module that can be licensed by partners.

The business model proved to be the right approach, as it allowed more development time and brought the copy trading module to its debut with the right business partner. In early 2020, the copy trading module ended its beta phase and was presented for the first time. The initial setup was initially done without any COV token integration, but the Covesting team later introduced support for the COV token at a later date, which is now live.

Present: Covesting Copy Trading and COV Token Utilities

Covesting is a peer-to-peer copy trading community that connects followers with strategy managers via a software module in the PrimeXBT dashboard. Covesting Copy Trading is currently available exclusively on the award-winning margin trading platform, which is known for long and short positions on more than 50 different CFDs; however, B2B partnerships could be expanded in the short term at any time in the fast-moving crypto industry.

With a Covesting account, anyone can become a strategy manager if they feel they have the skills. The software itself and the transparent risk and success metrics provided by the global leaderboards ensure that these strategy managers work transparently and honestly. In addition, followers can choose a strategy manager that best suits their personal goals or risk appetite.

Followers can follow one or more strategies at any time and manage these positions similarly to margin trading positions with stop-loss or take-profit orders. The module makes it possible to automatically copy all trades of the strategy manager. If successful, the followers will participate in the profits. The strategy manager also receives a cut to create incentives and trade actively.

Strategy managers, in turn, will be able to increase their capital much faster and tap into new sources of income. At the same time, followers who might not otherwise survive in the markets can now benefit from those with more experience. They then have to compete with other strategy managers to climb the ranks of the fully transparent global leaderboards or get all five stars – each with unique risk, success, revenue or margin parameters.

The Covesting (COV) token is the native cryptocurrency for the copy trading module, which was originally introduced as an ERC-20 token. Covesting developers have since released a bridge to the Binance Smart Chain for more “cross-chain” flexibility, allowing users to take advantage of the various protocols and decentralized applications unique to each blockchain.

The native utility token was introduced with a maximum total supply of 20,000,000 COV, making it scarcer than, for example, BTC. Deflationary mechanics further reduce the token supply through systematic token burns initiated by Covesting developers. More than 660,000 COV have been burned through these methods.

Users can track the supply and other various metrics related to the COV token in the “My COV” section of Covesting on PrimeXBT. In addition, COV token holders can access the features that the token offers in conjunction with the Covesting copy trading module in this area of the PrimeXBT dashboard.

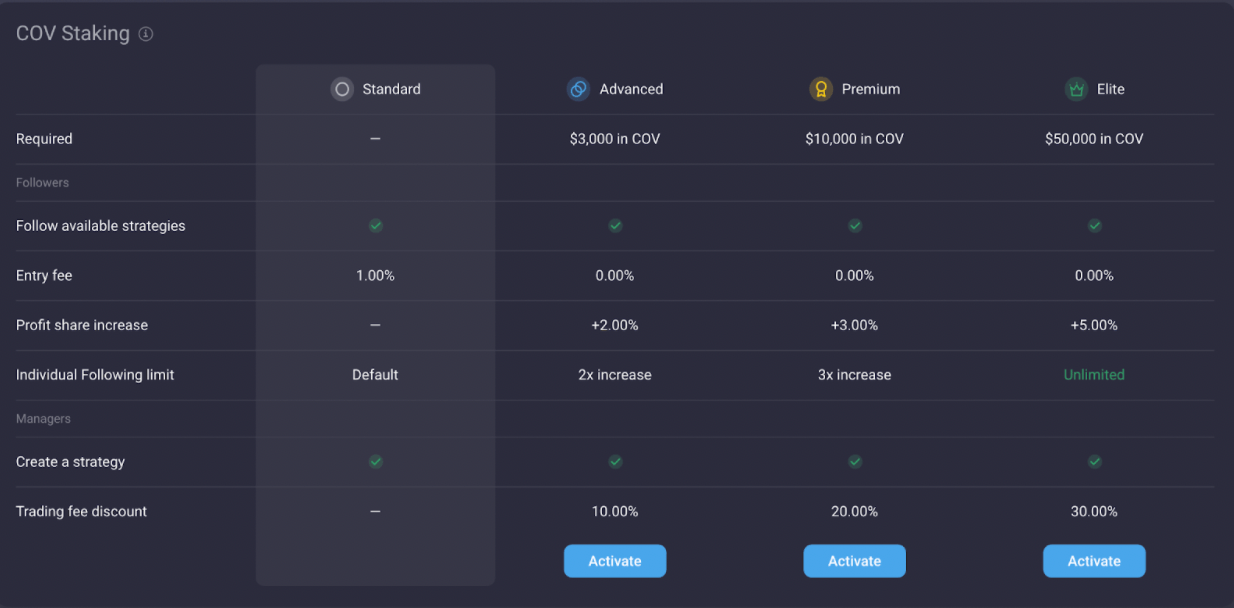

There is also an area dedicated to COV token staking in the same My COV section of the PrimeXBT dashboard. With COV staking, users unlock all utilities at the account level within the copy trading module. The larger the number of locked COV tokens, the more utilities are unlocked for the token holder.

By using COV tokens, users can turn a standard account into a Premium, Advanced, or Elite account with PrimeXBT. All three levels eliminate the 1% fee for new members, while the remaining features vary from level to level.

At the premium level, for example, followers increase their profit share by 2%. Strategy managers receive a 10% discount on trading fees, and follower limits are doubled. At the Advanced level, the profit share for followers increases to 3%, and strategy managers receive a 20% discount instead. Their follower limits also triple.

Finally, the elite level offers the greatest value and benefit with a 5% increase in profit sharing for followers, a 30% discount on trading fees, and no follower limit whatsoever. Without a limit on the number of followers, the earning potential is as great as the reach.

Access to COV tokens for purchase can be obtained via KuCoin, Uniswap, or directly via the PrimeXBT dashboard via the Exchange tool. This is a relatively new feature that allows users to exchange one type of cryptocurrency for another, including one of the base account margin currencies available on PrimeXBT. Although the list of currencies includes USDT and USDC, COV is only available for exchange via the COV/BTC and COV/ETH trading pairs.

Future: What to Expect from Covesting and for COV?

The Covesting development team always seems to be thinking one or two steps into the future, be it an update to the copy trading module, improved tokenomics for COV, or something completely new. Earlier this year, they unveiled a tool that will further increase the utility of the COV token. This tool is called Covesting Yield Accounts.

The Covesting Yield Account system is located in the Covesting section of the PrimeXBT dashboard next to the copy trading module, COV staking, supply statistics, and more. The new tool offers cryptocurrency holders up to 35% APY on their unused crypto tokens held on PrimeXBT.

Everyone has heard of DeFi at this point. One of the most popular ways this new sector of cryptocurrencies makes money for token holders is through variable yields paid out as crypto rewards. Different DeFi protocols have unique ways of achieving this, but perhaps the most popular example lately is how it works with automated market making platforms like Uniswap and PancakeSwap.

With centralized cryptocurrency exchanges, the exchange itself provides liquidity that users can access. However, with decentralized exchanges or automated market maker platforms, users provide liquidity by staking tokens in a smart contract. Locking tokens provides enough liquidity within trading pairs to facilitate market activity.

An exchange would typically generate revenue in the form of fees based on this business model. Since no company is involved, the DeFi protocol pays rewards to users who offer liquidity as an incentive to do so. When demand is high, the interest rates paid are also highest. For this reason, interest rates in DeFi are variable in most cases.

The concept behind it is clear, but connecting wallets to the blockchain and decentralized applications to move and stake coins can be confusing and downright dangerous for those who don’t know how to do it.

However, in Q3 2021, Covesting will introduce the Covesting Yield Account System, which enables a user-friendly and straightforward connection to top DeFi protocols such as Uniswap or PancakeSwap without requiring any technical knowledge. The Covesting Yield Account System Dashboard takes over the connection for you directly within the PrimeXBT Dashboard.

By using the tool, users can much more easily take advantage of the industry’s best variable APY rates that DeFi has to offer. This is also where the recently announced COV token utility was revealed to have an effect. According to the company blog, staking COV tokens can unlock an additional benefit of up to 2x APY Boost within the Covesting Yield Accounts. Users can also now sign up for an introductory 1% boost when they join an active waiting list in the Covesting Yield Account section of the PrimeXBT Dashboard.

The Next Development for Covesting and COV

Where the COV token goes next could ultimately depend on where the cryptocurrency industry develops next. When the COV token was first conceived, DeFi was hardly a thought, but today the utility token has evolved to even include the latest trends in the crypto industry.

Regardless of which direction things go and which features are introduced for the COV token for additional utilities, given the track record of creating an interesting value proposition for token holders, anything that comes will be a welcome addition to the financial world.