Amidst the emerging speculation surrounding the upcoming Bitcoin halving, expected on April 20, 2024, the crypto community’s attention is focused on possible price fluctuations. A new report by Vinicius Barbosa, a renowned crypto analyst, sheds light on the potential market movements that Bitcoin could experience in the coming months.

(BTC)

Bitcoin in Focus: Potential Market Movements before the Halving

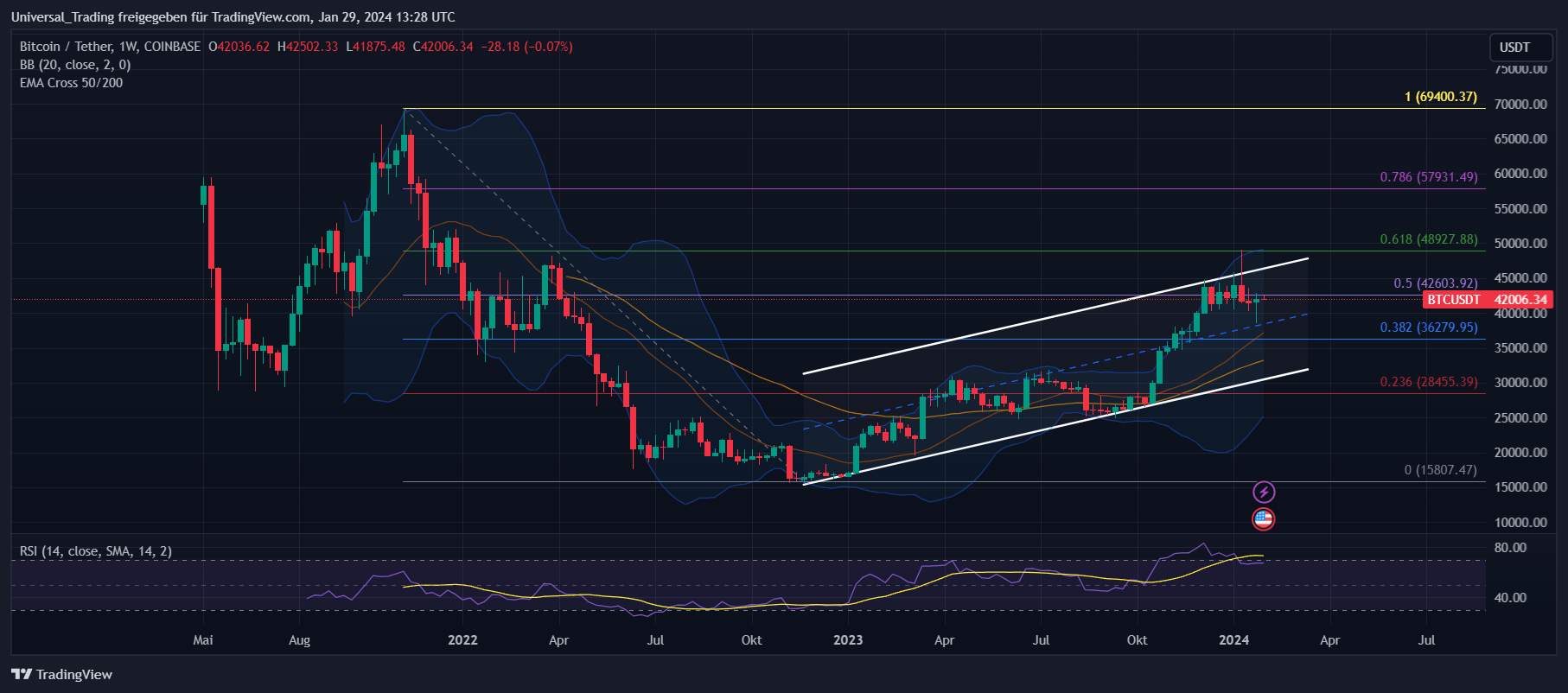

According to Barbosa, Bitcoin could experience a short-term rally, pushing the price up to $47,000. However, this upward movement may not last. The analyst predicts a subsequent decline into the $36,000 zone, based on the analysis of liquidity pools and previous price actions.

In February, the Bitcoin price could consolidate between $40,000 and $45,000. This phase of sideways movement could be interrupted by a short-term rise to $47,000 before the expected decline sets in.

Bitcoin Market Consolidation Expected: Significance for the Bitcoin Price Forecast

These predictions are particularly important for crypto investors who are trying to adapt their strategies in the run-up to the halving. The expected volatility offers both risks and opportunities.

You are currently seeing a placeholder content of X. To access the actual content, click on the button below. Please note that data will be passed on to third-party providers.

While the halving has historically often led to an increase in the Bitcoin price, this analysis underscores the importance of a cautious approach. Investors should closely monitor market conditions and carefully weigh their investment decisions.

The coming months promise to be an exciting time for the Bitcoin market. With the halving on the horizon and the potential price fluctuations predicted by experts like Barbosa, the crypto world remains a dynamic field for investors and enthusiasts alike.

Historical Patterns in Bitcoin and the Art of Crypto Analysis in Coin Price Developments

A clear pattern emerges in Bitcoin’s history: before each halving, there was a phase of consolidation or even a decline in price. These historical observations support CrypNuevo’s liquidity analysis and lend additional weight to the forecast that BTC could reach $36,000 in March.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: 10 Euro bonus when you sign up via CoinPro.ch

A look at the weekly chart of BTCUSD on TradingView reveals that a decline to the target of $36,000 would mean almost 14% loss from the current price of $41,810. This figure is in line with losses from previous years. Particularly striking was the loss of over 40% from the local high to the local low during the COVID-19 global crisis in 2020.

Future Prospects: No Guarantees for Bitcoin despite its Place as a Top Cryptocurrency

It is important to emphasize that historical price movements do not guarantee future events. Technical analyses based on probabilities can fail. The crypto market is known for its high volatility and unpredictability. Under certain conditions, everything could change.

Cryptocurrency traders and investors need to do their homework and understand the asset they are investing in. Macroeconomic factors, fundamentals, supply and demand, and movements by large market participants (“whales”) can significantly affect the price of Bitcoin. Therefore, caution should be exercised when speculating.

Analyzing historical patterns and considering current market conditions are crucial for understanding potential price movements in Bitcoin. While the upcoming halving is sparking optimism in the crypto community, the past reminds us that nothing is certain in the crypto market. Careful analysis and a cautious approach are essential for investors to be successful in this dynamic and often unpredictable market environment.

Future Trends in the Economic and Financial World and Their Significance for Bitcoin

In the world of cryptocurrencies, future developments and trends are of crucial importance. They have the potential to fundamentally change the market and create new dynamics. Particular attention is paid to the futures markets and their influence on the Bitcoin price.

Futures are contracts that provide for the purchase or sale of an asset at a fixed price at a future point in time. In the context of Bitcoin, they offer investors the opportunity to speculate on future price developments without having to own the actual Bitcoin. This can lead to increased liquidity and new price movements, especially when large futures positions expire.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: 10 Euro bonus when you sign up via CoinPro.ch

The Impact of Futures Trading on Bitcoin

Futures trading can have a significant impact on the Bitcoin price. On the one hand, speculation on rising or falling prices can lead to short-term volatility. On the other hand, the expiration of large futures positions and the associated settlements can influence the market by either leading to a sudden increase in buy orders or to selling pressure.

A concrete example of the influence of futures on the Bitcoin price was the sharp increase in December 2017, shortly after the first Bitcoin futures contract was introduced on a major exchange. Many analysts believe that the introduction of futures at that time led to increased interest and speculation, which drove the price up.

You are currently seeing a placeholder content of X. To access the actual content, click on the button below. Please note that data will be passed on to third-party providers.

Caution and Strategy when Trading Cryptocurrencies: Benefit from Bitcoin (BTC) Price Developments

In view of the potential impact of futures on the BTC coin price, it is important for investors to be cautious and pursue a well-thought-out strategy. Understanding the mechanisms of the futures market and the associated risks is crucial to making informed decisions and minimizing the risk of losses.

The future developments in the crypto market, especially in the area of futures, are an important factor that can influence the BTC price and the general market dynamics. Investors should closely monitor these developments and adjust their strategies accordingly in order to be successful in this rapidly changing market environment.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: 10 Euro bonus when you sign up via CoinPro.ch