Many crypto investors are overwhelmed when it comes to keeping track of their own transactions and trades. This is no wonder, given the numerous providers, thousands of cryptocurrencies, and high volatility in the market. The transaction and trading history is particularly relevant with regard to taxes. Most crypto traders can’t cope with doing it by hand or with Excel. In order to track your own crypto portfolio, tools are therefore necessary to take the work off our hands. One of the best products in this area is undoubtedly the offer from cointracking.info – a true pioneer in this field.

Ideal for your tax return in

- Germany ✔

- Switzerland ✔

- Austria ✔

- and many other countries ✔

What is CoinTracking?

CoinTracking is a tool for tracking your crypto portfolio. The Munich-based company has been active for around a decade. The online tool not only saves the trades, but also gives you, as a user, the opportunity to view more information about your profits and losses in detailed reports. Since this tool is primarily suitable for creating a tax report, you can also use the service to have tax and capital gains reports created for various countries.

How Does CoinTracking Work?

The service offers numerous functions – this can seem a little overwhelming for beginners at first glance. However, if you take a closer look at the tool, you will quickly find your way around. As the software is developed in Germany, the website is also offered in German. Other languages such as English, Spanish, Chinese and many more are also available. In the following, we will give you an insight into the scope of CoinTracking.

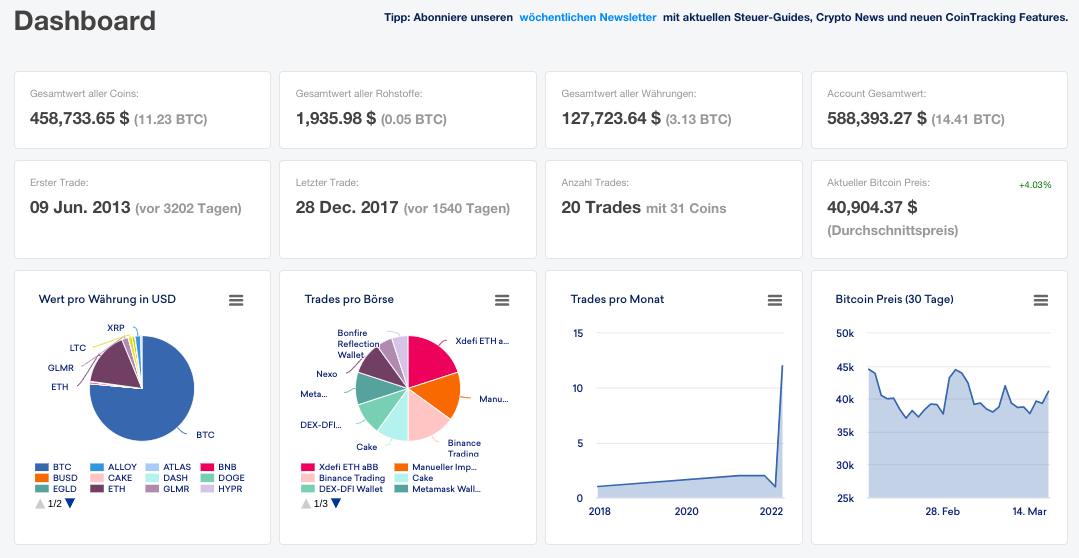

The Dashboard

The dashboard displays your personal trading history. At first glance, you will first receive some basic statistics about your trades. You can see how much your crypto portfolio is worth and how the total value of all currencies is made up, when your first and last trade was, how many coins you have traded and how your trades are divided across the exchanges.

Based on the two pie charts, you should already recognize that the tool supports numerous cryptocurrencies and exchanges. This brings us to the biggest advantage of the software tax tools for cryptocurrencies.

Automatic Recording of Trades

It is pleasing that you do not have to manually enter all your trades and transactions. The service supports all common crypto exchanges such as Binance, bitcoin.de or Kraken as well as numerous hardware wallets via interfaces. By connecting your accounts, your trades and transactions are automatically tracked by CoinTracking.

Nevertheless, you should of course check from time to time whether everything fits during the transfer or whether changes are necessary.

CoinTracking Taxes

The tax background is likely to be the main reason for using a tool like CoinTracking. The special thing about it is that CoinTracking works together with numerous tax firms to guarantee legal correctness. This allows you to adapt the software to various tax laws from numerous countries. A tool like CoinTracking is therefore particularly recommended for tax returns. In addition, the annual statements are generally accepted by the tax office.

Ideal for your tax return in

- Germany ✔

- Switzerland ✔

- Austria ✔

- and many other countries ✔

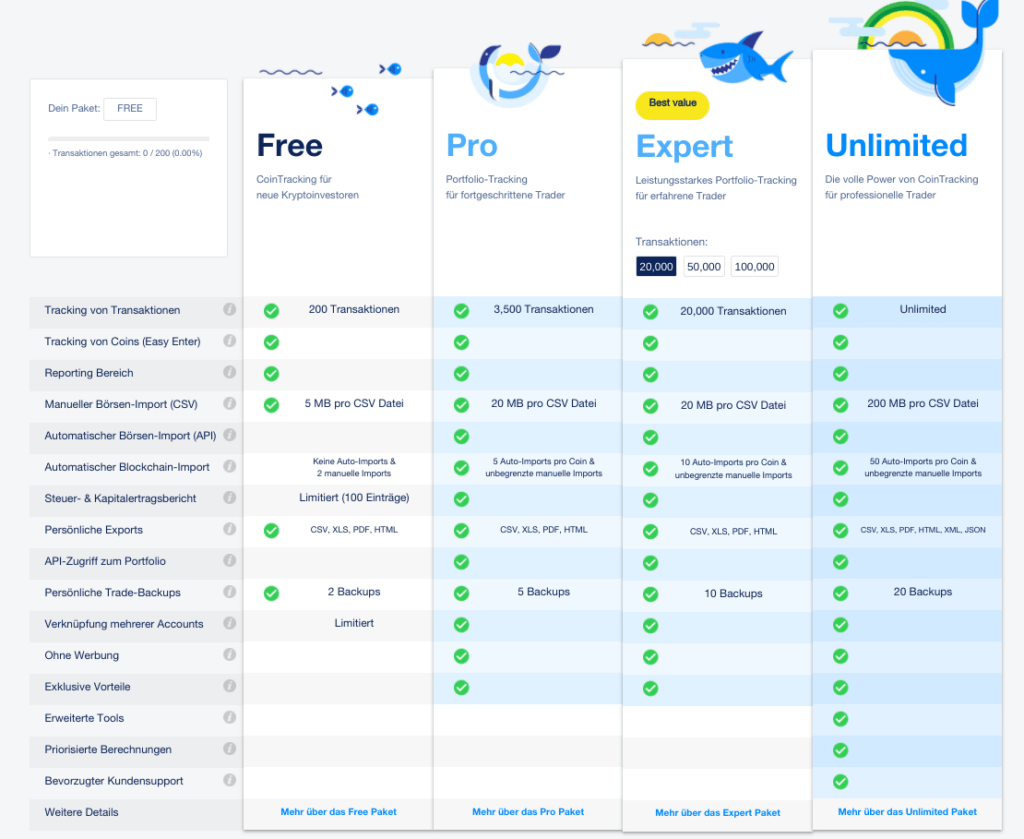

Costs and Fees

An important point when using helpful tools like CoinTracking are of course the costs and fees. Basically, the software is available in four different packages, which depend on how much you trade with cryptocurrencies. It is particularly pleasing that you are already in the free CoinTracking package

The costs for CoinTracking differ depending on whether you want to take out a one-year subscription or book the service directly for two years. Alternatively, it is also possible to buy the tool for an unlimited period of time – direct purchase is possible in each of the three paid packages. In order to be able to use the Unlimited package for an unlimited period of time, just over €5,000 is due, while the cheap subscription costs just €10.99 per month (CoinTracking Pro).

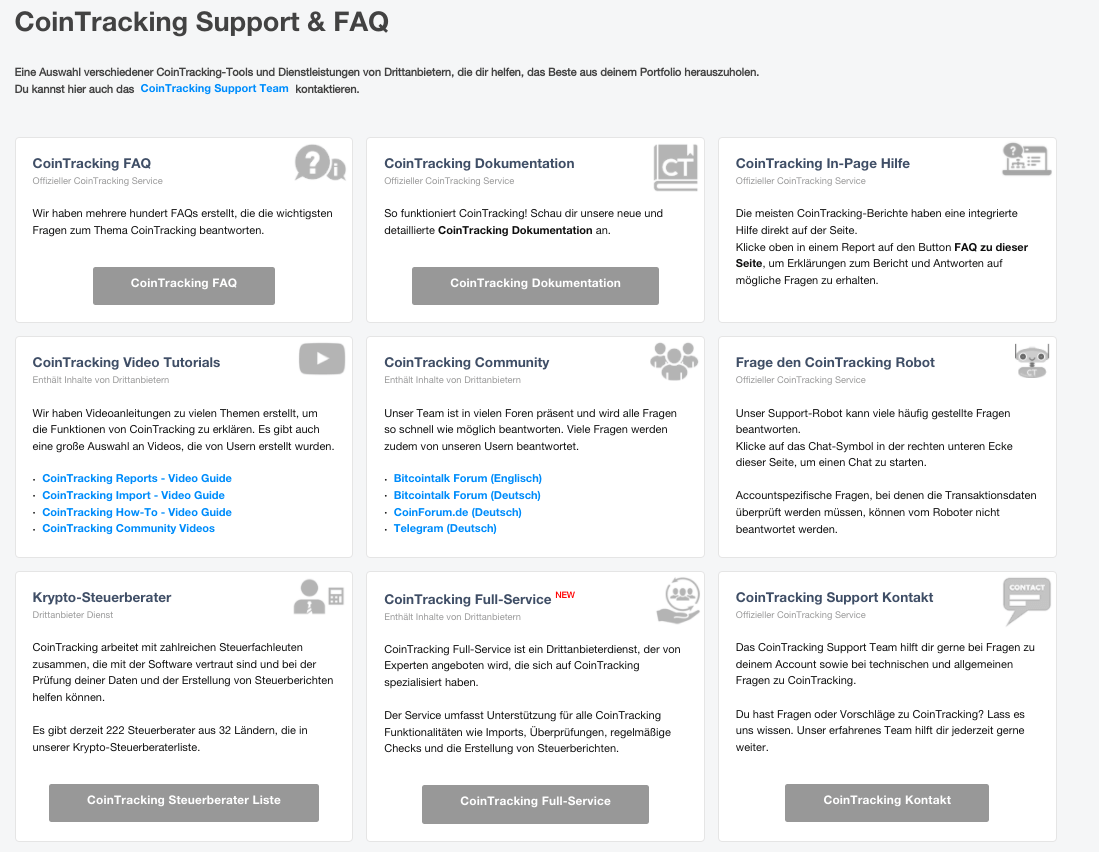

Our Experiences with Customer Service and Support

Especially in the cryptocurrency sector, it can quickly happen that you need support. Due to its location in Munich, the customer service is of course able to process German inquiries, which is particularly advantageous for users from Germany, Switzerland and Austria.

First of all, CoinTracking impresses in the 2026 test with an extensive support area where you can already find a lot of helpful information.

As you can see, the team has created numerous videos and also opened threads in the most important forums (BitcoinTalk and CoinForum.de) as well as its own Telegram channel, where users of the tool can exchange ideas.

CoinTracking attaches great importance to accessibility. You can create a ticket in German or English, and you will usually receive an answer within a few working days at the latest. Often it is even faster.

Especially because it can be very difficult to find a tax advisor who is really familiar with the topics surrounding cryptocurrencies, we also find the tax advisors that CoinTracking lists to be very helpful. What is particularly impressive in this case is that there are more than 200 tax advisors from 32 countries.

CoinTracking Full-Service

If you can’t find your way around CoinTracking on your own or want to feel even more secure, the service offers an option that is particularly practical. With CoinTracking Full-Service, the software actually takes care of everything for its customers. It is therefore an all-in-one solution that is designed to ensure that all data in the reports is correct. The developers receive support from qualified tax advisors. The user decides for themselves which tasks CoinTracking should perform.

Conclusion: is the Tool Worth it for Crypto Tax?

In our opinion, the service is ideally suited to collecting your own trades and transactions in a clear manner and creating a tax report without much effort that is also accepted by the tax office. Especially given the ambiguities in the crypto market, tools like CoinTracking are ideal for dedicating yourself entirely to investing without wasting additional time on recording the data.

The range of functions is very extensive. Here you can see that CoinTracking has been on the market since 2012 and has made numerous adjustments and improvements. The costs for using the tool are manageable when you consider how many reports you can create. CoinTracking definitely convinced us in the 2026 test. By registering via the banner below, you can also receive a 10 percent discount on a package of your choice after a free trial.

Ideal for your tax return in

- Germany ✔

- Switzerland ✔

- Austria ✔

- and many other countries ✔