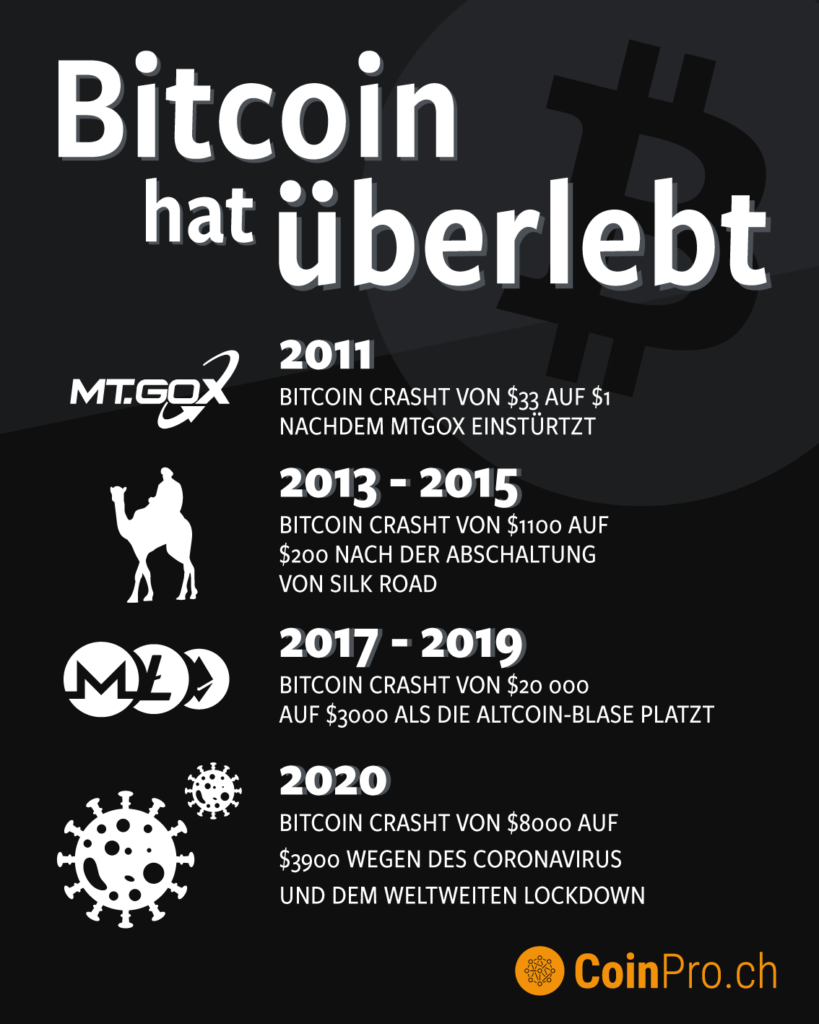

These days there is constantly new bad news on the crypto market. The development of the Bitcoin price is a good example. But how dramatic is the development really and how justified are concerns that the entire crypto industry is being talked into an existential crisis due to the rising corona infection numbers? The fact is that in the past ten years there have been repeated problematic situations in which the BTC price has crashed dramatically. But as the saying goes: Those who are written off live longer. So let’s take a look at some of the major crisis situations, the causes and the actual effects.

Crisis 1: the Bitcoin Crash in 2011 after the Mt.Gox Break-In

After its founding in 2009, Mt.Gox K.K. was considered a beacon of hope for many fans of digital currencies. From Japan, the company started its success story in the first phase after the market launch. One year after the start of business, the original trading platform for Bitcoin investors became a “real” crypto exchange. But the company’s history was not only accompanied by positive headlines. The year 2011 is considered by many industry experts to be one of the first black ones for the sector as a whole. The stock market crash did not follow until 2014. But there were already problems in 2011. Security gaps in the platform software and the resulting hacker attacks led to massive price corrections for the leading currency in the crypto world.

It was striking how quickly slumps in prices for digital currencies can occur. In the worst phase in mid-June 2011, the Bitcoin price crashed to just one US cent. However, this was only able to curb the high flight of numerous cryptocurrencies for a short time. After that, the currency successively recorded new increases, which continue with interruptions to this day.

Crisis 2: Silkroad Suspends Activities – Bitcoin Price Falls to 200 US Dollars

In the case of the provider Silkroad Online, it was also an Asian provider. The platform from Korea is a service provider that was very successful in the field of online gaming early on. Players have been able to use the service free of charge since 2005. It was a provider through which gamers could exchange money for game-internal services. The Bitcoin played a role in the game client earlier than many competitors. From 2013 onwards, there were reports of the closure of the Russian platform variant. This measure was followed by an international abandonment of the service. For Bitcoin, the developments meant gradual price losses from a former 1,100 US dollars per BTC to 200 USD in the worst phase. But the price of the first and still most important cryptocurrency recovered from this course as well. On the contrary.

In the period that followed, the digital currency not only more than made up for the previous slump. In fact, the price found itself in ever new price spheres and could only be influenced to a limited extent, regardless of the various setbacks.

Crisis 3: the Altcoin Bubble Bursts – What Happened to Bitcoin?

The developments in the years after the crisis as a result of the “Silkroad dilemma” already show that Bitcoin and thus also Altcoins are increasingly becoming a separate, more or less independent area of the financial market. Because what had happened despite all the difficulties until 2017? Even if Bitcoin for many investors is still more of a speculation object than a permanent investment for the portfolio was and is, the coin experienced a more than impressive upward movement. This was the only way the next slump was possible at all. In connection with the scenario titled in the media as “bursting of the altcoin bubble” in the period from 2017 to 2019, a decline from temporarily 20,000 US dollars per coin to only 3,000 dollars was emerging.

But Bitcoin also recovered from this setback, while at the same time there were many products on stock exchanges and in the financial sector that have not survived the developments to this day. There is no question that the currency is far from its provisional high. Nevertheless, losses were offset again to a not inconsiderable extent.

Crisis 4 – the Corona Virus and the Consequences for the Crypto World

In recent years, many analysts have developed the theory that digital currencies – especially Bitcoin – could become a safe haven in times of need, parallel to the precious metal gold, when the markets collapse. The Corona virus has shown that cryptocurrencies are not immune to slumps in the general economic situation either. Once again, there was a more than serious slump in the Bitcoin price at times. As recently as the third week of February, the price per Bitcoin was just over 10,000 US dollars. Almost four weeks later, the price was temporarily below 4,000 US dollars. How did the price develop afterwards? Bitcoin returned relatively quickly to the area above 5,000 dollars. This once again showed that declines are actually part of the everyday life of all crypto investors. Due to its “natural” limitation of the available Bitcoins, it can certainly be assumed that the digital gold will continue to develop significantly positively in the future.

The more confidence in classic investments dwindles, the more Bitcoin and Altcoins will gain more followers. Some experts also expect profits if banks in particular develop further interest in the blockchain and thus in Bitcoin or alternatives such as Ethereum and Ripple due to the crisis.

Conclusion on the crises of the Bitcoin price:

What do we learn from the previous crises that Bitcoin has gone through? Ultimately, it is also the increasing connections to the traditional financial sector that leave traces in the crypto world. However, the developments also demonstrate that digital currencies are not an instrument that appears and disappears for a short time. Increased state regulations, acceptance by banks and other economic sectors and, above all, the ever-increasing enthusiasm for the blockchain will ensure that Bitcoin and Co. will increasingly enjoy increasing demand and prices even in the event of fluctuations. It is normal for a clean-up to be imminent from time to time. But that does not mean that Bitcoin will not experience upward movements again and again.