Ecological movements such as “Fridays for Future” have experienced a lively influx not only in Germany, Switzerland or Austria in recent years. Internationally, too, people are increasingly attaching importance to sustainability and environmentally conscious action. It goes without saying that this also leaves its mark on the investment market. Investors worldwide are increasingly asking themselves what the future of investing in times of climate change might look like. The first important message: Many experts emphasize that ecological awareness and investments do not have to be mutually exclusive. The asset class of cryptocurrencies is particularly often criticized when it comes to sustainable speculation and investment. And in fact, politicians and energy experts are quite right when, in public statements, they warn of the sometimes extreme energy consumption that is common within many crypto systems. Crypto mining is particularly often referred to as a risk to the environment.

Developers of Digital Currencies are Looking for a Way out of the “Energy Crisis”

As correct as such assessments are, it is often concealed that the crypto industry has also been undergoing a transformation for some time. The essential question for investors with crypto interest is simply whether there are systems in the crypto universe in which environmentally conscious users can invest with a clear conscience. The answer: There have long been so-called “green” cryptocurrencies, whose environmental footprint is far better than that of the supposed major environmental offender Bitcoin. No wonder, because the industry is aware of the existing problems. Many developers are working to make existing currencies and technologies more sustainable and to create new, better projects. This in turn is increasingly putting Bitcoin under pressure.

Criticism of Bitcoin Consumption Continues to Grow

The leading digital currency has had eventful weeks. Because not only regulatory authorities and environmental associations have taken aim at the world’s first cryptocurrency. With Tesla founder Elon Musk, one of the big names in the crypto world expressed himself negatively about BTC several times. The result was the end of Bitcoin as a payment option when buying a Tesla vehicle. The coin had only recently been added to the electric car manufacturer’s portfolio of payment options. But this withdrawal of trust is, as I said, not the first criticism of the proverbial downside with regard to environmental aspects and the large CO2 footprint of the successful cryptocurrency. Especially since the accusations can easily be directed at a number of other crypto formats.

Mining as the Cause of High Electricity Consumption

In a special way, the environmental pollution in connection with crypto mining is at the center of the media attacks on the market. So it is only too understandable that more and more newcomers, but also experienced crypto investors, are increasingly looking for the aforementioned green coins and tokens as a possible investment. For many, the publication of the Cambridge Center for Alternative Finance was the latest reason to question their own crypto investment strategy. The institute is responsible for the so-called Cambridge Bitcoin Electricity Consumption Index. The index deals with the question of energy consumption in connection with mining, i.e. the creation of new BTC coins in the network. This process takes place almost in real time. The experts at CCAF recently determined the annual consumption to be around 120 terawatt hours per year as part of their projections. This corresponds to almost a fifth of Germany’s annual electricity consumption. Compared to smaller states such as the Netherlands, Bitcoin – seen negatively – is even ahead.

Earn Money with Mining without a Guilty Conscience Thanks to Renewable Electricity

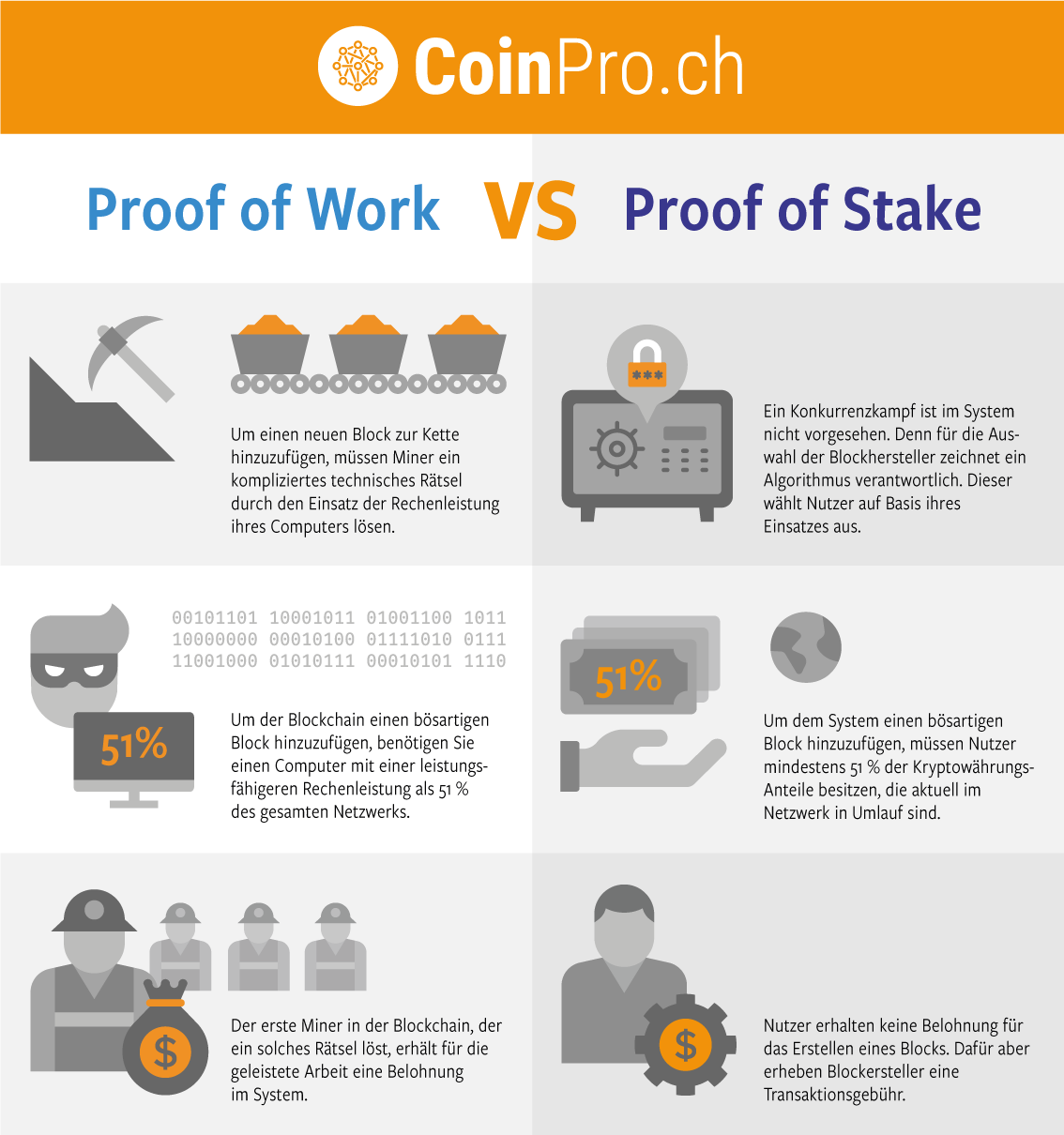

The reason for the high consumption is the Bitcoin consensus protocol called Proof-of-Work (PoW). Through this process, Bitcoin transactions are confirmed (validated) using a complex mathematical formula. The energy requirement is due to the mining devices that perform the calculations. But there is a rethink. Bitcoin developers are also working to reduce previous consumption. Users who earn (want to) money through mining rewards also have opportunities to open up opportunities without ecological remorse with a view to the future of investing in times of climate change by consciously choosing electricity from regenerative sources (keyword: wind or hydropower). Anyone who relies on green electricity as a miner to mine coins can still participate in the boom of PoW-based crypto systems.

In addition, many networks in the crypto universe have recognized and are using the Proof-of-Stake (PoS) process as a way out of the “energy crisis”. Significantly less electricity is required for mining and protecting these systems. We would like to briefly introduce five of these green and more environmentally friendly currencies at this point. The list is of course not complete and is constantly getting longer.

Model 1: Ethereum (ETH)

Ethereum or the system-internal coin Ether is the number two among cryptocurrencies on the market after Bitcoin in terms of market capitalization. Created in 2013, ETH forms the basis for the booming area of so-called DeFi projects today. As part of the update to Ethereum 2.0, the previously used PoW protocol is undergoing a gradual transfer to the PoS approach. Like Bitcoin, Ethereum has benefited from the boom in the market for years and continues to offer investors amazing return opportunities to this day. is being converted. From a technical point of view, Ethereum is innovative and individually applicable, especially due to the so-called dApps. Said dApps are decentralized programs that offer users countless application options – for example for digital contracts. After the complete PoS conversion, Ethereum will rightly be considered a green cryptocurrency in the future.

Model 2: Cardano (ADA)

The network and the currency ADA already relies on operating the blockchain on the basis of a PoS protocol. Experts have long seen this system as the “new Ethereum”. Not least because of the sustainable functionality. Cardano also convinces many investors in terms of scalability, who are not only aiming for quick speculation success, but also appreciate the technology. Cardano is currently (as of 09/2021) in fourth place among digital currencies with the highest market capitalization. The development team around founder Charles Hoskinson wants nothing less than to achieve the revolution of (digital) trade. Hoskinson attests the Cardano protocol Ouroboros an efficiency that is 1.6 million times higher. The token is considered promising by many analysts. Price slumps cannot be ruled out as with all cryptocurrencies. Nevertheless, there are always impressive breakouts upwards.

The Alonzo upgrade is expected to make Cardano even more energy-efficient

Model 3: Nano

The system including the associated currency Nano is not only characterized by the fact that users can use it free of charge. The general waiver of mining processes makes the currency particularly sustainable for many industry experts. For transactions and network-internal consensus processes, the system relies on a voting process, which also gives the currency a particularly energy efficiency. The basis is the consensus mechanism Open Representative Voting (ORV). Users factually vote on every transaction. Nano is considered one of the currencies with the smallest footprint in terms of CO2 because of the points mentioned. So far, Nano has not yet made the leap into the top 100 leading cryptocurrencies. But this in particular suggests that in view of the constantly increasing interest worldwide, it is worth taking a closer look here in the search for green cryptocurrencies.

Model 4: Polkadot (DOT)

Polkadot is the best proof of how closely different crypto systems can be connected. Inventor Dr. Gavin Wood was also one of the Ethereum co-founders and has been working for years on the (further) development of new crypto algorithms and codes for smart contracts that are used in the Ethereum network. Polkadot’s goal: The Parachains process is intended to close existing technical weaknesses and gaps in the Ethereum network. Above all, Parachains ensures that transactions are simplified in order to minimize the risk of system overloads. High fees, as they increasingly occur in the case of Ethereum in connection with dApps, should also be prevented by the special procedure. Polkadot is currently in ninth place among the largest cryptocurrencies by market capitalization. Here, too, there were regularly good opportunities for investors who want to invest in cryptocurrencies in an environmentally conscious manner.

Model 5: IOTA (MIOTA)

If you are looking for environmentally friendly digital currencies, but do not want to take as high a risk as with many coins and tokens on the market, you should take a closer look at the IOTA network and the MIOTA currency. However, the better stability of the course is in a way both a curse and a blessing. Because the lower volatility compared to other cryptocurrencies presents investors on the other hand with the problem that acute record profits are unlikely to be expected in many market phases. However, especially long-term investors like to find refuge in the IOTA system and have often been able to realize high returns in the past with the necessary patience. The network is characterized by a relatively low energy consumption. Various analyzes have determined a consumption of only about 0.11 kilowatt hours per transaction. The developers are also striving for a further reduction.

As I said:

Cryptocurrencies do not necessarily have to be environmentally friendly. But the good news is that they certainly can be. The selection on the market is now so large that ecological concerns are no longer an argument against entry. It is important to deal in detail with the respective technical conditions and then make the right decision. In addition, it is noticeable that thanks to the ever-increasing competition, developers are constantly looking for new ways to improve environmental compatibility. The result is increasingly efficient, cheaper and safer networks.

Environmentally Conscious Betting on Crypto Courses as an Alternative

There are also opportunities on the market for all crypto enthusiasts who do not want to buy directly. Options, contracts for difference and other crypto-related financial products are booming. In this way, market participants can specifically speculate or bet on price movements without a physical purchase. But be careful: Even in this case, transactions at least indirectly influence the energy consumption of the systems. In addition, the operation of trading platforms, crypto exchanges and server systems in this context also consumes electricity. The future of investing in times of climate change looks quite optimistic under the line. However, finding the right approach requires investors to familiarize themselves with the topic in general and the special features of various currency systems.

More Insights on Investing and Cryptocurrencies

This post was created as part of our nomination for the finanzblog-award. You can vote for our site until October 1, 2021.