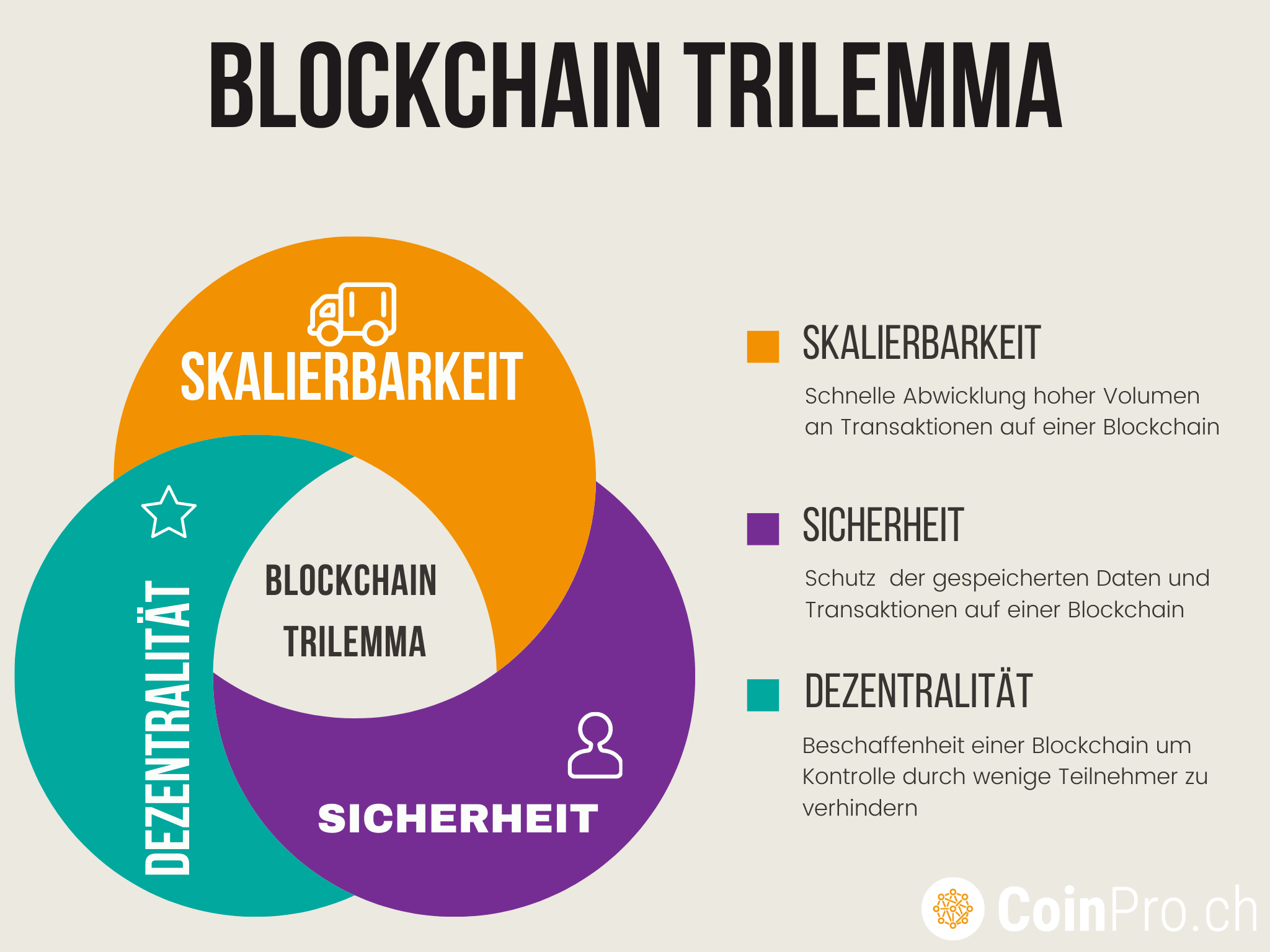

Blockchain Trilemma – the “eternal” problem of all crypto networks? There is no doubt about the numerous technological advantages of the blockchain. Especially in direct comparison with many traditional databases and systems, most blockchains on the market know how to convince. Nevertheless, there are also some “critical” aspects to the new technology. This concerns, on the one hand, the scalability, which sooner or later reaches its limits in many networks. Decentralization and network security cannot be endlessly expanded either. Experts therefore speak of the so-called Blockchain Trilemma.

First of all, this section will provide a brief definition of the three terms scalability, decentralization, and security:

- scalability refers to the ability of a blockchain-based network to gradually process a higher volume of internal transactions

- decentralization prevents only a small group of participants in the network from taking control – the term “network redundancy” is also commonly used

- in blockchains, security refers to the ability to protect information stored in the respective network against attacks (e.g. by hackers) and, on the other hand, to form a kind of defensive wall against so-called “double spending” in the system

Worth knowing: → Laypersons in particular run the risk of recognizing the blockchain or scalability trilemma as an immutable law. However, it is by no means impossible for a particular blockchain to function optimally with regard to scalability, decentralization, and security. For a better understanding, here is a brief digression on how and for what reasons public blockchains realize the points mentioned. The Bitcoin blockchain is intended to illustrate the three blockchain qualities mentioned.

The Bitcoin Blockchain

A cornerstone of the Bitcoin (BTC) “system” was the elimination of the “double spending” problem – without the involvement of central bodies. In centrally aligned networks, this problem generally played a subordinate role. The BTC blockchain aimed to make values exchangeable between network parties – not least through a reduction in trust, which simplifies the process. This reduction is achieved by excluding central network units. Unlike fiat currencies, for example, where central banks act as a control body (or central clearing house), Bitcoin depends heavily on various miners.

To ensure that most of the miners involved have sufficient time for transaction checks, blockchain blocks are integrated into the chain with a delay. The fact that this time expenditure is at the expense of speed was quite intentional on the part of the Bitcoin developers. Entirely in the spirit of the desired decentralization. If transactions are to be processed more quickly or, alternatively, scalability is to be increased, the time delay would have to be removed, which would have a negative impact on decentralization. As an “original blockchain”, every other blockchain contains technical cross-references and interfaces to the BTC system, to a certain extent.

Scalability, Decentralization, and Security Interact in the Blockchain

Step one for every network: It needs a consensus on transaction validity in order to be able to execute transactions at all. The unwritten rule: The more system participants, the longer it can take for participants to agree. This results in – given comparable parameters with regard to security – a scalability with an “inverse proportionality” with regard to decentralization.

Using the example of two blockchains with a proof of work consensus and an identical degree of decentralization, this means: The hash rate in the network can represent security here. With the hash rate height, the time for transaction confirmation decreases on the one hand. On the other hand, scalability increases when security increases. This results in scalability with a proportional course to network security with constant decentralization. Achieving the optimum values for all three properties in the blockchain is therefore excluded by definition. A certain willingness to compromise is therefore always required in the network.

For example, experts like to refer to the Ethereum case from the recent past when explaining the trilemma. Thanks to the boom in the field of decentralized finance (DeFi), the ETH network recorded a real application boom. As a result, the system reached its limits in terms of scalability. The consequence was massively increased fees for transactions due to the enormous demand. Due to this increase, it was simply not possible for many users to become active within the blockchain at times.

This fee development impressively illustrates the blockchain trilemma. Continued scaling is only possible at the price of temporarily neglecting the qualities of security and decentralization. In the Ethereum network, the community shifted its main focus to decentralization. This led to restrictions in scalability by drawing a clear line for the transactions that can be carried out per second. In order to encourage miners to give preferential confirmation to their transactions, users were willing to pay comparatively high fees.

For comparison:

In the blockchains of Bitcoin and Ethereum, decentralization comes first. The Ripple system, which is primarily designed as an innovative payment network, focuses on the security aspect. EOS, on the other hand, emphasizes scalability, so that decentralization and security are only in second place.

The Importance of the Trilemma Components in Detail

The examples mentioned above already show that the three components are of different relevance depending on the orientation and use cases of different blockchains. Let’s take a closer look at the components – this will cover both the special properties and positive and negative aspects.

Scalability

The more users, use cases and, last but not least, transactions a blockchain recognizes, the more important scalability becomes. It refers to the blockchain’s ability to do justice to system growth and to guarantee activity without compromising network performance even with significantly increasing adaptation. It is essential here that blockchains reduce the execution or processing time of individual transactions and thus, conversely, can “increase” the number of transactions per second (TPS), so to speak. Once again, it takes the aforementioned willingness to compromise to achieve this goal.

Variant 1:

a security compromise – the block time is reduced in the network, which is accompanied by a reduced network difficulty

Variant 2:

a decentralization compromise – within the network, the units entrusted with checking individual transactions are reduced. Networks with a focus on scalability are characterized by these advantages:

- Systems are able to ensure support for a large number of transactions

- Networks of this type are well suited for apps (applications) that do not focus on security → for example, apps from the social media sector

The disadvantages of scalability-centered networks are recognizable:

- Security inevitably plays a subordinate role

- the underlying consensus mechanism must automatically “scale with” when the network scales as such → the result can be a greater centralization of the blockchain

Decentralization

Blockchain networks that work in a very decentralized way are able to provide the necessary support to a large group of blockchain users (actors). Decentralization plays a role on many levels. For example, with regard to the miners and developers active in the network or the fully available system nodes, i.e. the nodes. It is important in this context that the extent of decentralization varies between different blockchains.

Decentralized blockchains are characterized by the following advantages:

- Decentralization allows a constant consensus to be maintained. The need for blockchain users to trust only one instance active in the network is not given

- One reason why decentralization is so important: It ensures greater system robustness. The associated systems are not susceptible to censorship and guarantee each participant their individual property rights

Disadvantages and possible problems of decentralized blockchains:

- Decentralized networks work relatively slowly, and at the same time decentralization causes delayed execution of transactions

- Decentralization is associated with high costs due to the “redundancy” it introduces. This makes it more of a hindrance to certain applications

Safety

When talking about security in a blockchain, it is about a network being able to irrevocably fix or maintain transactions. The basis for this guarantee is rewards in the form of own resources that participants in the systems have to invest. The higher the expenses, the higher the blockchain security. Once the term “double spending” deserves mention here. In the past, there was an attack on the Ethereum Classic network, for example. By securing a share of 51 percent of the total hash power, the attacker managed to realign more than 4,000 ETC blocks. The incident (with a double-issued ETC contingent worth almost two million US dollars at the time) was possible because the attacker had to spend less for the hash power mentioned than the blockchain values were worth at the time of the 51 percent attack to the rewards invested by participants in the blockchain.

These aspects are considered advantages of blockchain with a focus on security:

- Blockchains of this type also allow transfers with a very high value

- they work both cheaper and faster than other blockchain methods

- the members of the networks themselves ensure security in public blockchains

The main disadvantage of security-centered blockchains:

- a greater need for resources (investments, rewards, etc.)

Final Summary on the Blockchain Trilemma

For years, the scalability of many blockchains – not least the Bitcoin blockchain – has been criticized. Ethereum has also repeatedly struggled with problems in this regard. The Hardfork Bitcoin Cash (BCH), for example, reacted to the earlier difficulties with regard to scalability by increasing the size of individual blocks in the chain. In the Bitcoin universe, on the other hand, Layer 2 solutions have been intended to provide a remedy for some time. In other blockchains, too, there are always new ideas in this context to eliminate weaknesses from earlier years than the world. So far, there are no perfect concepts – strictly speaking, from an expert’s point of view, this cannot really exist due to the constant change and increasing interest in blockchain technology. In the future, it will continue to be a central challenge for systems to achieve the best possible “mix” of the qualities of scalability and decentralization on the one hand and security on the other.