As the only coin in the top 20, Zcash is still recording price gains. Since yesterday alone, ZEC has already risen by 20 percent. Since September, the privacy coin has increased its market value by almost 1,000 percent. Why the project is now making gains while Bitcoin and others are incurring losses.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

Zcash Price Surge: Privacy Coin Rises by another 70 Percent

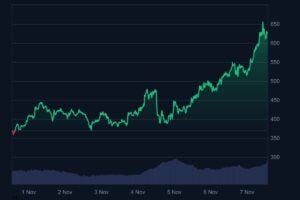

Zcash (ZEC) continues to experience a price surge. Since September, the privacy coin seems unstoppable. In the weekly trend, the cryptocurrency is currently rising by an additional 73 percent. Over the last 24 hours alone, price gains of 20 percent were achieved.

ZEC is consequently trading at $622.60. Meanwhile, the project’s market capitalization stands at $10.2 billion. Zcash thus ranks 13th among all cryptocurrencies.

Recently, the cryptocurrency had risen to become the top representative in its category. Until recently, Monero had led the ranking of privacy coins for many years. Now Zcash has a significant lead. Monero ranks 22nd with a market capitalization of $6.6 billion.

Particularly noteworthy: Among the 20 largest cryptocurrencies, Zcash is the only project currently able to achieve price gains. All other coins are experiencing price losses. The Bitcoin price decreased by about three percent since yesterday. After an 8.80 percent price decrease in the weekly trend, BTC is now only trading at $100,000.

Why ZEC is Rising while BTC is Falling

How does ZEC manage to rise so massively, even as market leader BTC falls? Usually, Bitcoin dictates the general market trend. Only rarely do cryptocurrencies succeed in resisting the trend of the largest cryptocurrency.

ZCash is currently benefiting from a rapidly growing demand for privacy coins. The topic of confidential cryptocurrencies is currently experiencing a boost. The industry understands the disadvantages of transparent blockchains and recognizes the encryption of its data as necessary.

In view of this, in September, Ethereum, with the PSE, created a working group that deals exclusively with privacy on the blockchain. Ethereum creator Vitalik Buterin had previously expressed concern that ETH could degenerate into a tool for surveillance.

As time progresses, the analysis of blockchain data becomes increasingly effective. Through the collaboration between crypto services and blockchain analysts, pseudonymous blockchain addresses can increasingly allow conclusions to be drawn about real identities.

Anyone who uses a privacy coin like Zcash instead of a transparent blockchain like Ethereum or Bitcoin avoids these surveillance attempts. ZEC has risen by 920 percent since September and is thus considered the most successful beneficiary of the trend.

Similar developments can also be observed with other privacy coins. Monero is also currently showing positive figures and is rising by 9.90 percent in the weekly trend. Dash recorded a 130 percent gain over the last seven days, ZKsync increased by 112 percent, and Decred shot up by 84 percent. The list continues.

Blockchain Industry Recognizes Encryption as Necessary

According to a report by asset manager Grayscale, the blockchain industry often recognizes the encryption of the blockchain as necessary. For years, some experts have been expecting a similar development within the industry, similar to what happened years ago on the internet.

The internet was initially dominated by the unencrypted data protocol HTTP. This was eventually largely replaced by the encrypted variant HTTPS.

That privacy on the blockchain is gaining increasing importance can also be seen in Zcash itself. In addition to encrypted transactions, the network also allows transparent money transfers. In 2024, only ten percent of all addresses were encrypted. Now it’s 30 percent.

“Blockchain technology cannot realize its full potential without privacy-related elements: Many users do not want their assets, income, and expenses to be visible in a transparent public ledger,” explains Grayscale.

Therefore, institutional investments in the sector are also to be expected in the future.