The Bitcoin price is experiencing a significant crash. At times, the largest cryptocurrency falls to $75,000. Why massive pessimism is suddenly weighing on the crypto market.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

Bitcoin Price Crash: Why BTC is falling to $75,000

The Bitcoin has seen a massive price crash over the last few days. Yesterday, BTC reached a regional low of around $75,000. At the time of going to press, the largest cryptocurrency is trading at around $78,000, still 38 percent below its all-time high from October 2025.

- Bitcoin

(BTC) - Price $75,948.00

- Market Cap

$1.52 T

Bitcoin’s price losses in the weekly trend are therefore 11.14 percent. As usual, the market leader dragged the entire crypto market downwards. For example, Ethereum slumped by around 22 percent in the weekly trend, BNB fell by 12.50 percent and XRP lost 15 percent of its market value.

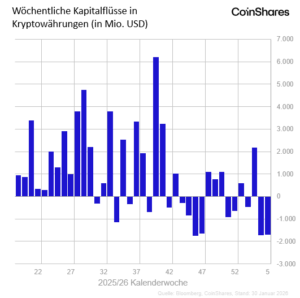

The price losses follow a drastically reduced investor sentiment. CoinShares is sure: The new pessimism comes in particular from the US market, which is actually regarded as a beacon of hope and should avert a crypto winter in 2026.

“This is due to a combination of factors, including the appointment of a more restrictive US Federal Reserve Chairman, continued sales by large investors (‘whales’) in connection with the four-year cycle and increased geopolitical volatility,” explained James Butterfill from CoinShares, as the company CoinPro сообщается in an email.

On January 30, US President Donald Trump nominated Kevin Warsh as successor to FED chief Jerome Powell. Powell’s term ends in May 2026. After that, Warsh is to take over the office.

However, Warsh’s nomination is causing pessimism on the financial markets. The candidate is considered a critic of quantitative easing and a supporter of a strong US dollar. For many investors, the nomination is therefore disappointing. President Trump is calling for low interest rates and wants to weaken the US dollar.

Although Warsh has not yet made any promises about his possible term as FED board member, the financial markets have already reacted conspicuously negatively.

Crypto outflows come from the USA, Europe remains optimistic

In its report, however, CoinShares also noted: The outflows from the crypto market come predominantly from the USA. Some European countries, on the other hand, remain optimistic. CoinShares considers the market for digital investment products here.

“At the regional level, the United States is recording outflows of 1.65 billion US dollars”, writes CoinShares.

Outflows of lesser magnitude can also be observed in Canada and Sweden – “with outflows of 37.3 million and 18.9 million US dollars respectively.” Meanwhile, comparable investment products in Germany and Switzerland were even able to grow.

“Very low inflows are recorded by Switzerland (11.0 million US dollars) and Germany (4.3 million US dollars),” it continues.

The outflows from the crypto market are comprehensive. Only a few cryptocurrencies are currently able to generate inflows and resulting profits.

“Across all asset classes, there is a broad negative sentiment: Bitcoin is suffering outflows of 1.32 billion US dollars, Ethereum 308 million US dollars, while the recent favorites XRP and Solana are also recording outflows of 43.7 million and 31.7 million US dollars respectively,” writes CoinShares.

On the other hand, Bitcoin shorts are benefiting, whose exchange-traded derivatives, according to CoinShares, were even able to grow by 14.5 million US dollars. Investors are now speculating on falling prices.

Buy Bitcoin now!