Anyone who follows the crypto market attentively has been able to observe the emergence of ever new products in the more than ten years since the launch of Bitcoin. Stablecoins, as they are now being developed by some banks and central banks, are just one such innovation. So-called non-fungible tokens are another example of new development that is attracting increasing interest. We will discuss what this is all about and what properties distinguish tokens in this segment. For many crypto fans, NFTs have become something like the “next big thing” in the crypto world. However, the sector is still in its infancy, so to speak. This makes the outlook on the special features that can already arise here in connection with a wide variety of use cases all the more exciting and meaningful.

NFT explained briefly: NFTs are cryptographic tokens that are not interchangeable. These tokens can neither be destroyed nor copied. Technically, NFTs are also stored on the blockchain.

Also worth reading: What are tokens and how do they differ from coins?

Recently, there have been repeated media reports about sports clubs (for example, in the US American basketball league NBA) that have discovered non-fungible tokens as an innovative instrument for involving their fans in important decision-making processes.

Interest in NFTs is Growing in many Areas

Some clubs also use the digital coins to involve fans in bonus and reward campaigns or to distribute tickets to upcoming games and events. A current example is also the US fast-food chain Taco Bell. Based on the Rarible NFT, works of art were awarded via a competition for a good cause. Over time, various other portals specializing in NFT have emerged worldwide alongside Rarible. Many observers expect the final big breakthrough for tokens in this crypto market segment in 2021. The digital coins are no longer a secret. There is also a lot of talk about a hype, although this term always has a somewhat stale aftertaste – because many hypes come to an abrupt end at some point. But first, let’s get to the explanation of the technical details to understand why non-fungible tokens are gaining importance in sectors from music to art and sports to countless other areas.

Tokens Cannot be Replicated and are Unique

One property of NFTs is their uniqueness. Non-fungible could also be defined as “non-exchangeable” in this context. Here, a significant difference to cryptocurrencies such as Bitcoin, Ethereum or Ripple becomes apparent. These “normal” digital currencies can be exchanged as so-called cryptographic tokens. Non-Fungible Tokens (NFTs), on the other hand, are characterized by the fact that they are both unique and cannot be replicated or destroyed. This makes the variants an exciting concept, for example, for the artistic sector to digitally distribute virtual art such as musical products. NFTs are also becoming increasingly popular with art collectors and gaming fans. In many games, tokens can be used to purchase and exchange virtual goods and assets. Non-fungible coins are becoming increasingly important in connection with the so-called DApps, which are developed on the blockchain of the Ethereum network (ETH) and offered to users.

Within the ETH universe, the protocol “ERC-721” has established itself as the standard format for the development of NFTs. The competitor TRON has also been working on its own counterpart for some time. Other development platforms are gradually following suit.

Gaming Community Makes Eager Use of NFTs

An often-cited example in the gaming context is the platform CryptoKitties, which enables the purchase and sale, but also the collection and breeding of virtual cats. The portal is basically a DApp and online game in one. Here, the Ethereum currency Ether serves as a means of payment. Precisely because digital/virtual goods are a rapidly growing market, NFTs as individual and unique tokens are enjoying increasing popularity. The fact that renowned brands such as Nike or Microsoft are driving forward their own token developments is also giving the sector more attention outside the crypto sector.

Impressive Growth within a Very Short Time

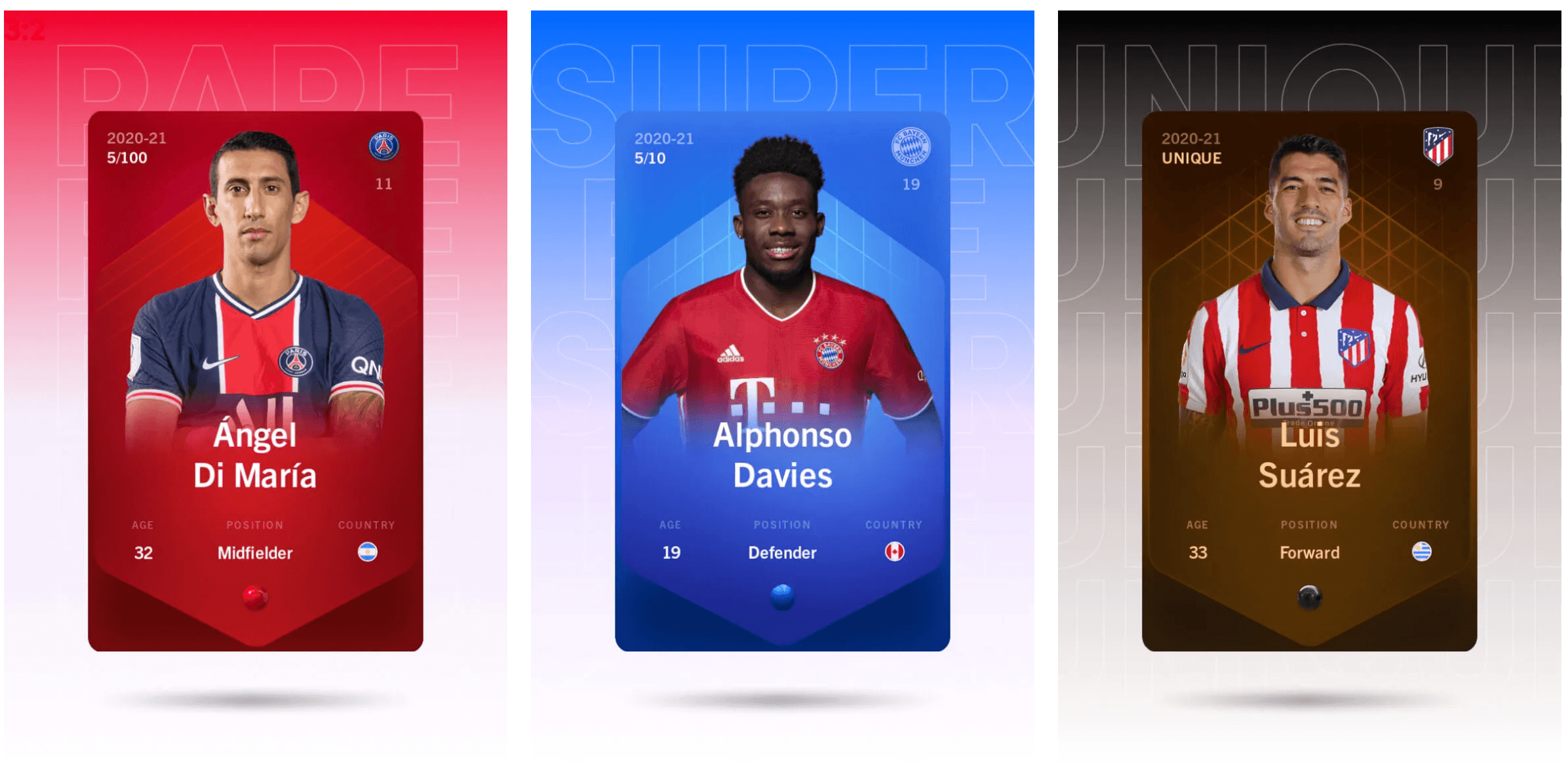

Many German media reported on the issue of player cards from the leading Bundesliga club FC Bayern Munich. The sometimes excessively high prices that consumers are willing to pay for individual products fuel hype fears in this context. Experts determined a market capitalization of almost 210 million US dollars for the entire NFT sector for the year 2019 alone – with a clearly increasing trend. No less interesting: For the period up to mid-2020, industry experts calculated a trading volume of around 100 million USD in the area of non-fungible tokens.

Art Sector as an Important Beneficiary of Non-Fungible Tokens

In the music business in particular, in addition to Rarible, there will be more and more choices for interested parties who want to secure digital rights to music in the near future. These can later – ideally, of course, profitably – be resold. The advantages for artists and collectors are obvious with NFTs. The tokens can literally put a stop to the downright inflationary spread of content. Coveted collectibles are and remain “uncopyable” and are also protected against counterfeiting thanks to the technical orientation of the non-fungible tokens. This is how they get their individual value. This distinguishes the new way of distribution significantly from the earlier type of duplication in the download and exchange portals often criticized by the music industry.

Music, sport and art in the digital space can finally regain a real and, above all, lasting value. Here, the technology of the blockchain proves to be an elementary plus point. Because it allows a clear proof of ownership of a wide variety of content. Furthermore, information in the blockchain is secured against data falsification. Holders or owners of the tokens retain full control – always and everywhere.

An (Incomplete) Overview of the most Important NFT Platforms

Wherever there is a gold rush atmosphere and new types of business are emerging, there are also a large number of providers on the market to profit from it. This is also the case with the NFT platforms, which are currently opening up every week. The currently relevant players are:

- Open Sea: The market leader with the widest range of virtual goods

- Decentraland: Virtual properties

- Rarible: The universal marketplace for the development and sale and trade of NFTs

- Enjin Marketplace: official marketplace for Enjin-based NFTs

- Super Rare: Focus on (digital) art

Warnings about Bubbles in the Market for Non-Fungible Tokens

The latest NFT developments, such as the Sorage platform, recently received the considerable sum of the equivalent of 40 million euros from some very well-known investors. Similar to the popular sticker albums that have been popular for many years, users can purchase and digitally collect digital cards here – also called collectibles. The player cards, in turn, are limited, which many fans equate with a likely price increase. If you ask convinced supporters of the concept of NFTs, a boom is guaranteed for the next few years.

| Useless knowledge part 1:

→ The most expensive NFT-based football card (approx. 63,000 francs) that has been sold to date refers to Mbappé from the French club Paris Saint-Germain. It will not be the last report on record payments. |

Even if the non-fungible tokens held in digital wallets (Wallets) are forgery-proof thanks to blockchain authentication, there are (as is almost always the case in the world of still quite young digital currencies) not only positive forecasts for the development of the industry. Although the market is growing and thriving at an astonishing pace – not least because many crypto users are afraid of missing a promising trend as long as it promises impressive profits. Critics are already warning that parallels to earlier problematic scenarios in the crypto universe can be seen in the area of NFTs. A common comparison is that to the wave of Initial Coin Offerings (ICOs) during the year 2017. At that time, the hopes of many investors who were infected by the euphoria were nipped in the bud. Because not every ICO project was a success.

Corona Problems Were Beneficial for the NFT Sector

On the other hand, there are the increasing numbers of users who have created a considerable fan base for NFTs in a short time. The experts at the nonfungible.com platform recently calculated a previous capital inflow of more than 370 million US dollars into the sector, which has long been more than just a niche in the crypto world. Above all, the popularity of the online gaming sector with games such as Axie Infinity and many others is promoting the trend to an astonishing extent. In some places, NFTs even served users as a helpful, sometimes even the only reliable source of income during the Corona pandemic. The Philippines, for example, is the best example. There, the creation of and trading with NFTs has become a “real” profession over time. Buyers pay six- or even seven-figure dollar amounts for goods. And this example is just one of many.

Increasing Interest from Well-Known Companies and Crypto Sizes

Optimism within the community is also ensured by the entry of large companies such as the globally active auction house Christie’s. The London-based service provider now auctions digital art on behalf of customers on the basis of NFTs, which change hands for millions. The influential Winklevoss brothers operate the Nifty Gateway platform, which is dedicated to the NFT topic and also offers works of art, among other things. The approach is not entirely new, because players like the “CryptoPunks” have been enabling the sale of digital art for around four years. However: Sales successes are by no means certain despite the boom. Nevertheless, artists of various directions in particular could become the profiteers of the enthusiasm for non-fungible tokens. Finally, a completely new distribution channel via the Internet is opening up in this area. Here, the digital world presents itself as a market of unlimited possibilities, so to speak.

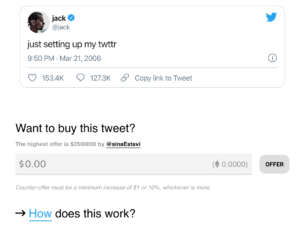

| Useless knowledge part 2:

→ Twitter co-founder and CEO Jack Dorsey sells his first tweet as NFT by highest bid.

→ The auction ended on March 22nd. The highest bidder @sinaEstavi pays 2.9 million US dollars. Dorsey wants to donate the money to a non-profit organization. |

Critical Voices with a View to High Energy Consumption

However, the disadvantage of non-fungible tokens, which many skeptics emphasize in particular with regard to the high energy demand and consumption, should not be concealed in all the enthusiasm. The criticism is quite justified. One critic: Memo Akten, a well-known artist in the field of artificial intelligence. He determined an average CO2 consumption of 47 kilograms per transaction in the NFT area. The concerns are of course not new and have been mentioned in connection with cryptocurrencies in general for years. New developments, optimizations of blockchain technology and, last but not least, the use of renewable energies could soon initiate the hoped-for turnaround in terms of environmental protection.

Last but not Least:

As with digital currencies such as Bitcoin, the enormous growth in the NFT token sector and the sometimes almost crazily increasing sales revenues on the market harbor the risk of a bursting bubble. But here, too, as with Bitcoin in recent years, the next, possibly long-term, upward trend could be just around the corner at the end of a clean-up.