Bitcoin gradually approached its all-time high but has now stalled somewhat. But also the number 2, Ethereum, the main driver behind the flourishing DeFi space, has reached an important milestone in which the $500 mark was exceeded. Will the Ethereum run follow?

The entire cryptocurrency market has benefited from a strong run led by Bitcoin. The leading digital currency is known for pulling the altcoins along with it, so it is not surprising that the second-largest cryptocurrency, Ethereum, also benefited. And ETH can also benefit as a strong platform for a variety of DeFi offerings, which have been making more and more headlines recently. In addition, a major upgrade is in the pipeline, where important milestones on the road to Ethereum 2.0 were recently launched. Some market participants seem to prefer a development towards staking rather than proof-of-work. Regardless, the developments around DeFi seem to have a greater impact on the market value of Ether.

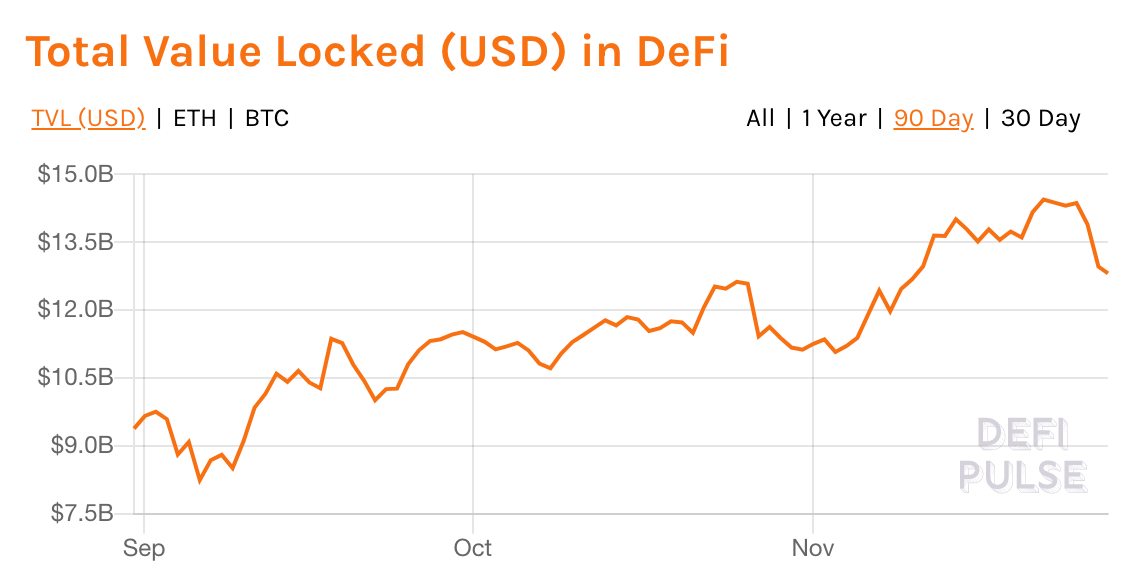

What is “True Value locked”? TVL stands for the amount of capital used in DeFi applications.

PrimeXBT’s leading analyst, Kim Chua, has predicted a rising TVL until November, but also noted that this will only show up in the market price with a delay. In her opinion, there is even more room for price growth thanks to the ongoing DeFi boom.

Ethereum Run? ETH Still Has some Growth Reserves

ETH has finally broken out above $500 despite the strong selling pressure that pushed the price down many times in November due to uncertainty about the launch of ETH 2.0. After ETH crossed $500, it continued to over $600. Now there is not much standing in the way of ETH’s price to rise to $830, its next resistance area,” explained Chua of PrimeXBT.

On November 20, Vitalik Buterin, the founder of Ethereum, warned of a possibly bad reaction to the update that the implementation of the full Proof of Stake could take another year. The actual goal for ETH 2.0 was only 25% achieved by November 20, but within just nine hours, Ethereum’s deposit contract reached its threshold of 524,288 Ether on November 24.

Despite the critical comments of the Ethereum founder, the price recorded noticeable gains and exceeded its preliminary resistance of $488 to an increase to $560 on Saturday. This shows that the price is not as strongly influenced by the development around ETH 2.0 as is generally assumed. Another reason could be that many investors assume that the supply of ETH on the free market will decrease with the date of December 1 and ETH, which was deposited in the ETH 2.0 contract, would have flooded things. Therefore, many investors are still buying ETH before December in anticipation of this supply glut.

The goal of ETH 2.0 has already been achieved: In just 2 days, around 400,000 ETH went into the deposit contract. At the time of the article, even more ETH are deposited (600,000). This gives an outlook on the hopes of the users in ETH. This is also supported by the recent resurrection of the altcoin market.

DeFi as a Driver

As already mentioned, the developments around DeFi seem to fuel the fantasies of investors even more than the upcoming update to ETH 2.0. “In fact, I think this could be more important for the price of ETH in the future than the update to ETH 2.0. The rise in price was preceded by a revival of activity in the DeFi space”, Chua said. The multitude of DeFi projects are based on Ethereum and operated. Therefore, there is always the causality, when the demand for DeFi offerings increases, the price of ETH follows shortly thereafter.

As can be seen from the chart above, the TVL in DeFi projects has risen from USD 10.5 billion at the beginning of November to currently USD 14.4 billion, which corresponds to a growth of 40% in just three weeks.

Anyone who wants to participate in yield farming on an ETH-based platform must buy the ETH to send it to the platform and start yield farming. An increase in DeFi TVL (total value locked) therefore naturally leads to an increase in ETH demand and, in return, to an increase in the ETH price. Therefore, this development of the ETH price is not a surprise, as TVL in DeFi has risen sharply since the beginning of November. The price finally reflected the demand last weekend. An indication of an Ethereum run?

Given the declining confidence in traditional banking products such as fixed deposits due to extremely low interest rates and a corresponding increase in confidence in cryptocurrencies, DeFi products are expected to challenge and take away some of the traditional financial demand from adventurous and tech-savvy individuals.

Therefore, capital on DeFi platforms is expected to continue to grow, despite some minor problems with the loss or theft of funds. The demand for ETH is therefore expected to increase at the same time. If you think that DeFi is the future of finance, ETH will continue to play an important role in the future.

Looking at the price history, there doesn’t seem to be much standing in the way of ETH rising to $800. However, it is suspected that the increase will slow down or retreat slightly after the ETH 2.0 deposits have been made.

“This is because part of the rapid price increase was due to the fact that the participants of ETH 2.0 wanted to join in order to buy up the ETH in order to make their deposits”, added the PrimeXBT analyst. “Now that most of this rush purchase is complete, we may have to wait until December 1, when ETH 2.0 officially launches, for the euphoria to return to ETH.”

After the successful launch of ETH 2.0, there will be another potential price catalyst – EIP 1559, which has been postponed until after the launch of ETH 2.0. EIP–1559 is supposed to have a part of the transaction fees “burned”, which could have a deflationary impact in the long run. The more ETH is used, the more ETH is taken out of circulation. This is an important price catalyst that has not been talked about much in the market yet. The implementation can take place soon after the launch of ETH 2.0 and is the next big event to watch out for. Some Ethereum clients such as Nethermind and Besu have already started implementing EIP 1559 in test networks. After the successful launch of ETH 2.0, the full implementation of EIP 1559 should not be too far away.

Outlook and how it could Continue

In summary, the fundamentals for ETH are improving significantly.

- The increasing popularity of DeFi also leads to an increasing demand for ETH.

- By implementing the EIP 1559 upgrade, the supply of ETH will be reduced with each transaction.

- The reduction of the inflation rate of ETH in the coming 2 years according to the master plan (the supply of new ETH will also be reduced from currently 4.7 million to 2 million per year when ETH 1.0 and ETH 2.0 merge).

With so many factors that can influence the demand and supply of ETH, a strong upward trend in the price is within the realm of possibility.

These analyses were provided by PrimeXBT market analysts Kim Chua. Traders can trade Ethereum as well as a number of other popular cryptocurrencies with the award-winning PrimeXBT long or short positions – in addition to other assets such as Forex, gold, silver, oil, commodities and stock indices.