Only a few weeks remain until the Bitcoin Halving 2024. It is expected to happen in April. How will the Bitcoin price develop as a result? Why some analysts expect unusual market movements. CoinPro summarizes the most important information for you. This is what you should know now.

Bitcoin Halving 2024: What You should Know Now

The Bitcoin Halving 2024 is approaching. The impending event is considered particularly important for the Bitcoin price. The production of new BTC is halved by an algorithm. CoinPro explains exactly what this means and when exactly the eagerly awaited event will take place.

On What Date Will the Next Bitcoin Halving Take Place?

The Bitcoin Halving is triggered when a certain block height is reached. The date on which the event takes place cannot therefore be said with absolute certainty in advance. On April 20, 2024, the block reward was successfully halved.

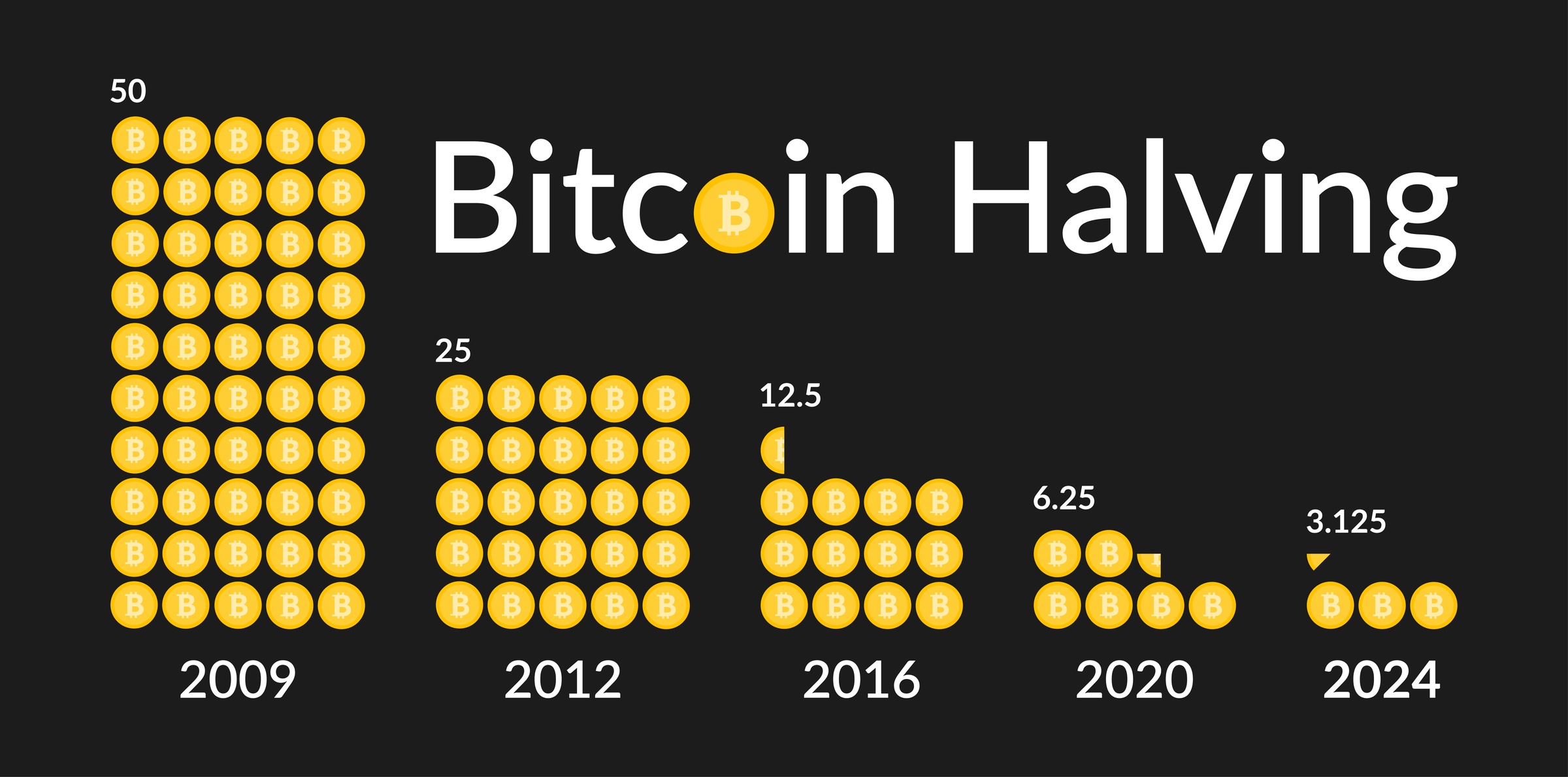

Every 210,000 blocks, the produced Bitcoin is halved. At the next halving in 2024, the Bitcoin blockchain must reach the 840,000 Bitcoin block for this to happen. This is the fourth Bitcoin halving in history.

The intended block time of the blockchain is ten minutes. However, there are repeated incidents in which a block deviates from the normal value. In 2022, block production was delayed by more than an hour.

In 2021, a block even took 122 minutes to be confirmed by the blockchain and distributed to nodes. As a result, the exact moment of the halving cannot be predicted with absolute certainty.

What is the Block Reward from 2024?

Miners receive a payment for each block of the blockchain they produce – the so-called block reward. From the halving in 2024, this value will fall to 3.125 BTC. Until then, miners will receive double the value of 6.25 BTC.

On November 8, 2023, 3.125 BTC is equivalent to a total value of 111,000 US dollars or around 100,000 Swiss francs.

How Does the Halving Affect the Bitcoin Price?

Among analysts, there is a unanimous conviction that the 2024 halving will have a strongly positive influence on the Bitcoin price. However, it is less certain how sustainable the resulting gains will be.

Among Bitcoiners, the hope for the start of a new bull market through the Bitcoin halving is huge. Some analysts suspect that the market value of Bitcoin will remain comparatively low despite the halving of the block reward.

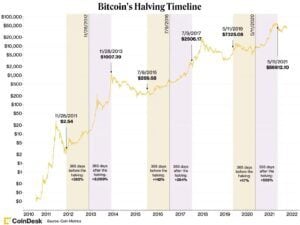

Historically, a strong price increase can be clearly seen as a result of Bitcoin halvings. So far, the event has already taken place three times. In 2012, 2016 and 2020, significant price gains followed the reduced block reward each time.

- Halving on November 28, 2012: 9,600 percent gain in the bull market.

- Halving on July 9, 2016: 3,050 percent gain in the bull market.

- Halving on May 11, 2020: 720 percent gain in the bull market.

It is worth noting that the price increase largely occurred when the halving had already been completed. Immediately before the event, there were repeated price losses – these were particularly evident in 2020, when BTC slipped from around 9,000 US dollars to 5,000 US dollars.

That’s why a Price Analyst Expects a Bitcoin Crash Shortly before the Halving

Price analyst Shelby Moore expects a Bitcoin crash shortly before the 2024 halving. According to his findings, the cryptocurrency will repeat a movement that already occurred in March 2020.

A short time later – in May 2020 – the third Bitcoin halving took place and quickly boosted the trading value of BTC to almost 10,000 US dollars. In the following months, a bull market lasted until April 2021, which boosted the coin to up to 61,500 US dollars. In one fell swoop, several previously unattainable values were broken.

Moore therefore advises his followers to sell their Bitcoin at the current market value. He writes:

Sell your Bitcoin. We will be able to buy them back below $15,000 before the halving.

The analyst does not predict an exact date for the crash. He dates the prophesied event to the first half of 2024. Since the halving is expected to take place in April, BTC will, according to his findings, plunge to 15,000 US dollars in the period from January to April. The almost 50 percent losses from March 2020 are expected to be repeated.

Can a Bear Market Follow the Halving?

Moore expects a rapid increase in the Bitcoin price after the successful halving. Pessimists consider this assessment to be too positive. According to the well-known analyst Credibull Crypto, the bull market in which we are currently in his opinion will end in spring 2024 due to the halving.

This will be followed by a bear market that will lead to massive losses as early as 2025, writes the analyst. Although Credibull is a respected price analyst, his assessment is a rarity. Among Bitcoiners, his expectations are considered very controversial.

Why the Block Reward is Halved

Bitcoin has a fixed maximum supply. The protocol includes a program code that provides for a halving of the block reward at intervals of 210,000 blocks. This stretches the production of the cryptocurrency over many years.

The last Bitcoin is expected to be mined in 2140. Until then, the constant supply of BTC ensures that the network can be financed without any problems through the block reward and that the digital asset is issued decentrally.

The maximum supply of Bitcoin, limited to 21 million, ensures a scarcity of the currency, which is intended to prevent a loss of value. At the editorial deadline in November 2023, there are approximately 19.5 million Bitcoins in circulation.

Buy Bitcoin Now

The Best Crypto Exchanges!

The best crypto exchanges compared:

- Safety

- User-friendliness

- Fees

- Deposit and withdrawal methods

- Trading offer