Blockchain researcher AJC believes: Ethereum is at the end. The expert presents the declining network revenues that the blockchain has recorded over the last two years. CoinPro explains why validators tend to earn less money with ETH, even though the cryptocurrency is currently chasing one record after another.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

Ethereum at the End? Researcher Warns of Blockchain Collapse

Is Ethereum at the end? That’s what AJC, a researcher at crypto analysts Messari, believes. In an X post, the expert warns of the second largest cryptocurrency. The fundamentals of the blockchain are terrible – so much so that one must expect the collapse of the blockchain.

AJC’s assessment is surprising insofar as Ethereum has experienced a formal rebirth since the spring of 2025. Until the change of leadership of the Ethereum Foundation, ETH was in a deep crisis, which brought the development of the blockchain to a standstill. A resulting negative price development caused anger among investors.

Over the last few months, Ether has experienced many positive moments. In August, the cryptocurrency set a new all-time high, breaking a four-year-old record from 2021. Ethereum gained significant importance as an institutional investment as well as a reserve currency.

All of this could not convince AJC. The researcher considers these developments to be trivial. The problem of poor fundamentals, meanwhile, continues, he believes.

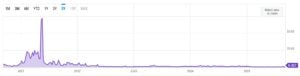

“Ethereum is dying. Although ETH reached new ATHs in August, Ethereum’s revenue in August was [only] $39.2 million,” AJC explained.

He made comparisons showing a significant decrease in profitability compared to 2024 and 2023.

“Profits down 75 percent compared to August 2023 ($157.4 million) and down 40 percent compared to August 2024 ($64.8 million).”

From this comparison, AJC draws a drastic conclusion. Because the network generates ever lower profits for validators over time, its demise can be seen.

You are currently seeing a placeholder content of X. To access the actual content, click on the button below. Please note that data will be passed on to third-party providers.

Ethereum’s Network Revenues are Falling – a Bad Sign?

AJC’s conclusion, however, is less clear than Ethereum’s declining network revenues. Validators, who are responsible for processing the transactions, benefit from these.

Initially, declining revenues can result in a decrease in active network nodes. A shrinking of the network is currently not visible according to Etherscan. Instead, the number is growing. At the time of going to press, 12,103 nodes are participating in the network.

Important to note: In the past, Ethereum was known for extremely high network fees. Ethereum’s mainnet was – and still is today – only slightly scalable. As a result, users had outbid each other to push through their transactions as quickly as possible. Some people invested the equivalent of several hundred or thousand US dollars, especially during the 2021 bull market, just to process transactions on Ethereum.

The Ethereum Foundation recognized the extremely high fees as a problem. Low fees are considered to be effective, as they allow a broad mass of users to use the blockchain. In addition, growing scalability should lead to more transactions being processed in a shorter time.

ETH increases its scalability by splitting the network into many partially dependent networks, which then process transactions for specific applications. Ethereum then only serves as a consensus layer.

The consequence of this concept is that Ethereum’s network revenues are falling. However, AJC’s assessment is not entirely wrong. The fact that the importance of the Ethereum mainnet is declining has been a growing point of contention for months. A declining popularity of the mainnet is considered an obstacle to its long-term development.

“It’s hard to say that Ethereum is at the end when the activity metrics actually show positive trends,” wrote user CryptoRick98, presenting current figures that show, for example, a growth in active blockchain addresses and absolute transactions compared to the previous year.

Hard to say Ethereum is dying when activity metrics have actually started showing positive trends though small.

App revenue is reaching ATHs, stablecoin supply ATH, and continued L2 scaling all point to the most flourishing decentralized financial system ever created, powered by… pic.twitter.com/l8x7CvMA3B

— Rick (@CryptoRick98) September 7, 2025