On Tuesday, the US Securities and Exchange Commission (SEC) met with crypto developer Mysten Labs. The studio is responsible for the well-known blockchain Sui. Just a few days ago, the SEC postponed applications for Sui ETFs until December. However, yesterday’s discussion focused on the broad crypto regulation in the USA.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: 10 Euro bonus when you sign up via CoinPro.ch

SEC Meets with Sui Developer Mysten Labs: What’s it about?

The US Securities and Exchange Commission (SEC) met with Sui developer Mysten Labs yesterday – this is according to public documents from the authority. Meanwhile, the crypto scene is wondering why the two organizations have made personal contact.

Just last week, the SEC made headlines in connection with the blockchain Sui. The stock exchange supervisory authority extended the decision on Sui spot ETFs and postponed them until December 21. The next due date will not be until the end of the year.

Crypto spot ETFs are currently a hot topic in the USA. So far, only the leading cryptocurrencies Bitcoin and Ethereum have received full approval. In July, resourceful asset managers succeeded in bringing a Solana ETF to their customers via detours.

Crypto funds are in high demand in the North American country, as institutional investors are increasingly venturing into investments in cryptocurrencies. Instead of buying the coins themselves, they prefer to take the route via regulated exchanges.

The acting US President Donald Trump promised far-reaching relaxations. Experts suspect that this promise will also have an impact on the ETF market. Many cryptocurrencies could become available via exchange-traded products that have been blocked by the authorities so far.

The expected release of new crypto ETFs has not yet occurred. The experts James Seyffart and Eric Balchunas suspect that this event will follow in late 2025.

Mysten Labs Wants to Influence the SEC’s Crypto Regulation

However, documents published by the SEC yesterday show that the recent meeting between Mysten Labs and the stock exchange supervisory authority was not about ETFs. As the developer of Sui, the development studio only plays a minor role here anyway. Asset managers from 21Shares and Canary Capital are responsible for the ETF applications.

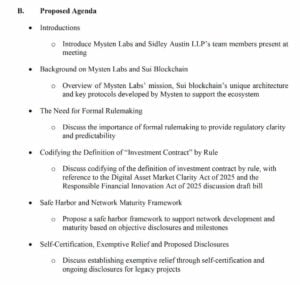

Sidley Austin, the legal representation of Mysten Labs, requested a meeting with the SEC as early as August 7. Topic of the conversation: “Regulatory issues related to blockchain technology and cryptocurrencies.”

A subsequently submitted schedule suggests that Mysten Labs wanted to speak to the SEC for more freedom for the crypto industry. For example, they raised the question of whether formal rules are even useful.

In addition, they discussed the infamous definition of investment contracts, which in the USA often has a significant impact on the jurisdiction and regulation surrounding crypto.

Mysten Labs submitted the proposal of a “safe harbor”. They suggested to the SEC to offer crypto developers more freedom to first carry out the development of a cryptocurrency without it being prematurely prevented by regulatory interventions.

Crypto regulation in the USA should therefore respect the self-disclosures of the developers. Interventions should take place based on certain milestones so that young companies are not crushed by the regulatory burden.

Details about the conference are not known. Mysten did not issue an official statement.

Discover the latest crypto news now!