A significant crypto crash is shaking the market. Over the last few days and hours, losses have been predominant in the crypto market. CoinPro explains why now is likely the right time to buy more.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: 10 Euro bonus when you sign up via CoinPro.ch

Crypto Crash: why Bitcoin, Ethereum, and Co. Are Falling Significantly

An increasing crypto crash has been observed over the last few days and hours. The Bitcoin price is showing a 4.93 percent loss in the weekly trend and is consequently listed at 111,528 US dollars.

- Bitcoin

(BTC) - Price $109,560.00

- Market Cap

$2.18 T

In the last 24 hours alone, the largest cryptocurrency lost 1.38 percent of its market value. Bitcoin’s losses are lower than the average. The entire crypto market fell by 2.30 percent in the same period – a drastic crash.

ETH is recording significantly higher price losses. In the weekly trend, the Ethereum price has already fallen by 12.58 percent. The second-largest cryptocurrency is now listed at $4,000. Among the top 10 of the crypto market, this drastic downturn is even surpassed by Solana, Dogecoin, and Cardano.

- Ethereum

(ETH) - Price $4,033.88

- Market Cap

$486.86 B

Solana fell by 18.40 percent in the weekly trend, Dogecoin lost 17.60 percent, and Cardano 14.40 percent of its market value.

The recent losses cannot be attributed to a specific event. Instead, an organic decline in market sentiment can be seen. Investors are moving away from their euphoric positions as important bullish milestones fail to materialize.

Buy more Bitcoin? That’s why now is the right time

In general, the crypto market is still in an optimistic situation – even if the recent losses may suggest otherwise. The US government continues to do beneficial work for the crypto market, even having international impact.

The US Securities and Exchange Commission (SEC) recently opened the stock exchanges for the mass and simplified listing of crypto spot ETFs – a long-awaited milestone. The US Federal Reserve (FED) now seems to be obeying US President Donald Trump and recently lowered the key interest rate. Further cuts are pending.

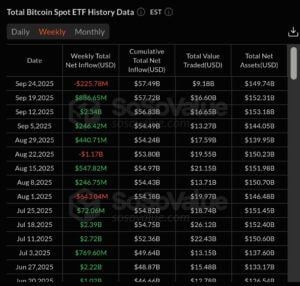

Institutional investments in cryptocurrencies are also not decreasing. Some gazettes are currently announcing the end of the institutional onslaught on crypto, but data from Sosovalue shows that the reality is different. Most recently, listed crypto assets recorded mild net outflows – nothing out of the ordinary.

Data from the well-known crypto aggregator CoinMarketCap assesses the current market situation as an excellent moment to realize follow-up purchases of Bitcoin and Co. According to this, investors are excessively pessimistic. The crypto crash is not comprehensible to this extent. If CMC is correct in this assessment, the market is now predominantly driven by emotions.

CoinMarketCap currently classifies the crypto market as oversold. An increase in oversold cryptocurrencies can be seen in the statistics over the last few hours. Only a few cryptocurrencies are currently overbought.

To create the value, the data aggregator uses the Relative Strength Index (RSI for short). The market situation was still neutral last week. There were only a few oversold and overbought cryptocurrencies.

At the same time, CMC suggests a speedy recovery. In fact, there are several events in the pipeline that could lead to fresh gains over the next few weeks and months. The US key interest rate is likely to continue to fall, the FED could introduce the so-called Third Mandate, and the launch of new crypto spot ETFs is pending.

Buy Bitcoin now!