As the first major cryptocurrency, Ethereum switched its consensus mechanism from Proof of Work to Proof of Stake in September 2022. The change is intended to form the basis for better scalability and energy efficiency.

What is Ethereum Staking?

Ethereum has been using Proof of Stake since September 15, 2022. Instead of mining, the network operators carry out what is known as staking. The former has therefore been replaced since then. This is made possible by the Ethereum Merge, which merged the actual mainchain with the Beacon Chain. It represents an important milestone in the development of the cryptocurrency to its next better version “Ethereum 2.0.”

From now on, Ethereum relies on staking. That is the process of a proof of stake. Users deposit their Ethereum and receive interest on their assets as a reward. Most users use centralized service providers such as crypto exchanges or staking pools for this. Solo staking is another option, but it is expensive and complex compared to other options.

The basic process always remains the same: From the nodes that operate staking, the algorithm called Gasper selects a validator who is responsible for validating and creating an Ethereum block.

How Can I Stake Ethereum?

There are several ways to stake Ethereum. There are many different types of Ethereum staking. Most users have ETH staking carried out by service providers. They deposit their Ether with crypto exchanges or staking pools.

However, users should note one thing: Ethereum that is staked today is locked up until further notice and cannot be withdrawn for an indefinite period. Their use for other purposes is then impossible.

This fact has already caused disputes and complaints from users in the past. According to the latest statements from Ethereum developers, it should be possible to withdraw staked ETH from March 2023.

Through Liquid Staking, users can already receive a return on their invested digital asset today. However, the service provider does not pay out Ether itself, but its own ERC-20 token. The best-known token of this type is the Lido Staked Ether (STETH) of the staking pool Lido.

Neben jenem empfiehlt die Ethereum Stiftung vor allem die konkurrierenden Anbieter Rocket Pool und StakeWise. Eine ausführliche Anleitung zum Ethereum Staking stellt die Stiftung ebenfalls bereit. Nutzer sollten niemals Staking über einen Dienst betreiben, dem sie nicht vertrauen. Coins können dadurch unwiederbringlich verloren gehen.

Ethereum staking is mainly suitable for long-term holders of the coin who do not currently use their assets and want to take the opportunity to passively generate profits. The returns are paid by users of the network through their gas fees.

Ethereum Staking Returns & Risks

Stakers are always exposed to the risk of losing the ETH they have invested. With solo staking, there is a risk of punishment from the network. If the operator’s Ethereum node goes offline, a fine will be imposed. The penalty depends on the period over which the node is offline.

Based on this, an amount is automatically estimated that the validator would have earned in the specific period and that amount is imposed as a penalty. In order to become a validator, the operator of the network node must deposit 32 ETH. On December 15, 2022, their value is around 40,000 Swiss francs.

Other elements are important when calculating the penalty. For example, how many other validators are offline. The more validators that are unreachable at the time, the higher the penalty payment.

The deposit of 32 ETH is mandatory to ensure the security of the network. In this way, malicious participants can be punished. If a node tries to attack the network, at least part of its assets will be confiscated. The network node is then excluded from the network.

If malicious behavior occurs, it comes to so-called Slashing. The Ether affected by this are subjected to a coin burn. They are practically destroyed and can no longer be used by anyone.

Since most staking service providers use trust-based systems, they could steal their customers’ investments at any time.

Ethereum Staking Returns: how much ETH Can You Earn?

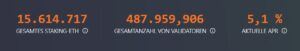

Currently, users can receive 5.1 percent effective annual interest (APR) on their invested ETH. This amount is slightly lower when using service providers. The Ethereum Foundation provides a live overview where users can get up-to-date information.

On December 15, 2022, there are 15,604,830 Ether locked in staking, for which 488,032 validators are responsible.

Ethereum Staking Withdrawal: how to Withdraw your Ether

So far, it is not possible to withdraw the staked Ether Coins again. This means that there is still a risk that you will lose your coins in the worst case. However, the Ethereum developer team is already working hard to enable Ethereum staking withdrawals. This should be possible from March 2023. Because with the Shanghai Update, Ethereum stakers will be able to withdraw their coins. As soon as it is ready, we will give you step-by-step instructions on how to do this.

Ethereum Staking vs. Ethereum Mining: Differences

Finally, we will give you a brief overview of Ethereum mining and the differences to the current staking.

What is Ethereum Mining?

Ethereum started in 2015 with a Proof of Work consensus mechanism. The name of the chosen algorithm was Ethash. Until 2022, the Ethereum mining was used to operate the network by validating new transactions and adding them to blocks of the blockchain.

In addition, the Ethereum miners created new Ether, which they received through the Block Reward. These functions are no longer available in this form since September. The former Ethereum miners switched to Ethereum Classic or the newly created blockchain EthereumPoW.

Ethereum mining was very similar to Bitcoin mining. However, the two blockchain networks used different mining algorithms.

That is the Big Difference between Ethereum Staking and Mining

Ethereum mining and staking differ in almost all points, because the two consensus mechanisms Proof of Stake and Proof of Work are fundamentally different. In particular, there is a big difference between ETH mining and staking for mass suitability: energy consumption. Because by switching from the Proof of Work to the Proof of Stake consensus mechanism, the Ethereum network requires around 99.9 percent less energy than before.

Conclusion: That’s What You should Know about Ethereum Staking

Ethereum staking describes the new way in which the Ethereum network is secured by the Proof of Stake consensus algorithm and how transactions are validated. In order to stake Ethereum yourself as a validator, you need technical know-how and a balance of 32 ETH – this option is therefore probably not an option for the average investor.

Therefore, there are now various services that you can use to stake Ethereum. This is done via crypto exchanges or so-called liquid staking providers. However, there is still no guarantee that you will be able to withdraw your coins in the end. The Ethereum team is working on this. From March 2023, however, it could be possible to withdraw Ether Coins.