What exactly is the Ethereum Merge and what should you watch out for? When will the Merge take place and how should investors behave? In the following, CoinPro explains everything you need to know about the big ETH update.

What is the Ethereum Merge?

A merge describes a merger in German. That’s exactly what happened at Ethereum in September 2021. The Ethereum Merge describes the merging of the mainchain (which is the previously active Ethereum Blockchain) with the so-called Beacon Chain.

Through the Merge, ETH realizes the change from its previous consensus mechanism Proof of Work to a consensus based on Proof of Stake. This change reduces the energy consumption of the blockchain and creates the basis for better scalability.

What is the Beacon Chain Anyway?

The Beacon Chain started on December 1, 2020 and marks Phase 0 of the Serenity upgrade, which is commonly known as Ethereum 2.0. So it represents the technical basis for the major update.

The Beacon Chain is a blockchain based on Proof of Stake that cannot process user accounts or Smart Contracts itself. It will later be responsible for linking shard chains and stakers.

Thanks to the Beacon Chain, Ethereum investors are able to stake ETH even before the Merge and thus earn money completely passively. Measured by the staked capital, Ethereum is already the most important PoS blockchain before Solana and Cardano even before the official change to PoS.

Why is the Merge Needed?

Ethereum went public on July 30, 2015. In the meantime, the project’s technology has become somewhat outdated. Currently, the blockchain manages to process approximately 15 transactions per second (TPS).

However, that is no longer enough. Due to the enormous use of the blockchain, there is congestion, which in turn leads to long waiting times and very high network fees.

To solve these problems, Ethereum wants to complete the transition to Ethereum 2.0. The Merge is the most critical event in this process. In addition, a new consensus mechanism is intended to reassure critics who consider Proof of Work to be harmful to the environment.

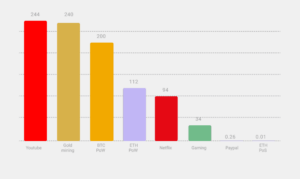

Ethereum’s throughput is expected to increase from 15 TPS to 100,000 TPS. Ethereum’s current electricity consumption of 112 terawatt hours per year is expected to decrease by 99.95 percent. The result would correspond to a value of 0.56 terawatt hours.

Ultimately, with an annual value of 0.01 terawatt hours, the aim is even to undercut PayPal with its 0.26 TWh.

The previous value corresponds to approximately the annual electricity consumption of the Netherlands. Switzerland’s energy demand in 2021 was 58.11 terawatt hours, as can be seen from a graphic shared by Statista.

When Will Ethereum Switch to Proof of Stake?

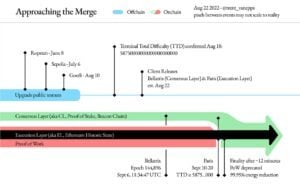

There have been semi-official announcements again and again. On August 24, the Ethereum Foundation published for the first time a very official date for the Merge. Due to technical circumstances, a period from September 10 to September 20, 2022 is defined for this.

The miners of the Ethereum network are decisive for the exact time. The hash rate, which in turn determines the mining difficulty, depends on their volume. The ETH developers defined a Total Terminal Difficulty, after which the Merge begins.

This TTD is exactly 58750000000000000000000. The value is calculated from the sum of the mining difficulty of all blocks ever mined within the blockchain.

Will the Merge Take Place on September 6?

Again and again one reads of the assertion that the Merge will take place on September 6. However, this does not mean the actual fusion, but the Bellatrix Upgrade.

The Bellatrix Upgrade is necessary to prepare the Beacon Chain for the Merge. Since the Beacon Chain is time-sensitive, the date can already be predicted to the second. It will take place on September 6, 2022 at 11:34:47 a.m. coordinated world time.

The equivalent upgrade of the ETH mainnet is called the Paris Upgrade and sets off the Merge, which is scheduled to be completed after twelve minutes.

Will Ethereum’s Scalability Grow through the Merge?

Proof of Stake alone does not lead to better scalability, but merely gives the blockchain the possibility of a higher throughput while maintaining the same security standards.

So the event of the Merge does not lead to an improvement in scalability. Proof of Stake enables network nodes to validate several shard chains at the same time. These shard chains increase Ethereum’s scalability.

The Ethereum mainnet then serves as a consensus layer, while various shard chains such as Optimism (OP) are responsible for processing the transactions.

What Do Users Need to Consider after the Ethereum Merge?

The situation is different for people who are more involved in the network. Miners should know: From the Merge onwards, any computing power provided for Ethereum is useless.

And the operators of nodes should also prepare for the upcoming event. So that your network node does not neglect its task at any time, two different clients must be provided. You can find details on this at the Ethereum Foundation.

If you would like to stake your Ethereum, please visit an officially provided guide from Ethereum.

The Merge is a critical event. Programmers who want to make sure everything runs smoothly or want to earn money can work as hardening testers and collect premiums of up to one million US dollars.

Is Ethereum 2.0 Achieved through the Merge?

The Ethereum 2.0 state is preceded by a multi-year process that started in December 2020 with the publication of the Beacon Chains and is expected to end in 2023.

After the Beacon Chain, the Merge is the next step. Ethereum itself refers to the Merge as Phase 1. However, after the fusion of the two blockchains, an important element is still missing: The increase in scalability.

This is to be achieved through the integration of shard chains (Phase 2), which are to be introduced by 2023. The Ethereum Foundation does not speak of Ethereum 2.0, but of the Consensus Layer, while the previous mainnet bears the name Execution Layer.

Does the Ethereum Merge also Have Disadvantages?

The Merge as an event could lead to technical errors. It is unlikely that such an error would have serious consequences. In the long term, the importance of layer 2 solutions could increase as a result.

More realistic are the disadvantages that arise from Proof of Stake. Many critics criticize the growing centralization caused by PoS – a disadvantage that Ethereum initiator Vitalik Buterin also admits.

PoS is essentially based on investing money instead of computing power. However, funds are traceable on transparent blockchains such as Ethereum and can therefore easily lead to the identification of the holder. Various sizes of the scene therefore fear growing censorship.

Does the Merge Affect the Ethereum Course?

In fact, the Ethereum Merge has changed a few things, which could also influence the ETH course in the future. For example, most analysts and experts in their Ethereum course forecasts assume that the lower energy requirements have opened the door for institutional investors. This could have a positive effect on the Ethereum course.

In addition, Ethereum will become slightly deflationary due to the Merge and the London upgrade carried out in the summer of 2021. This means that the amount of Ether coins in circulation will decrease. If demand increases or at least remains the same, this would mean that the ETH course would rise in the long term due to the simple principle of supply and demand. In the short term, there was a relatively strong price increase before the Merge, before these price gains were leveled out again within a few days. Nevertheless, Ethereum is currently trading significantly higher than at the time before the Merge. In our guide, we have described in detail how you can buy Ethereum.

Trade Bitvavo now at Bitvavo:

European exchange with EU license (MiCA)

over 180 cryptocurrencies

10 Euro sign-up bonus

- Deposit via PayPal

- Staking available

- low fees