Buying Bitcoin in 2025 without KYC – is that even possible anymore? CoinPro tested the Swiss provider Mt Pelerin, which promises exactly that. In addition, there are no fees on the first CHF 499. A new integration of the Lightning Network makes handling even more convenient for customers.

Buy Bitcoin 2025 without KYC: Here’s How

Since 2016, most states have been pushing drastic laws in the crypto industry. Usually, users have to identify themselves with an ID document. In addition, they have to share a photo of their face with the operators of the trading platforms.

The Swiss service provider Mt Pelerin takes a different approach. They want to offer their customers a classic user experience. In order to buy Bitcoin or other cryptocurrencies, no KYC process has to be completed.

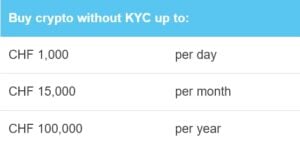

Instead, the customer transfers any amount by bank transfer and card payment. As long as a limit of 1,000 francs per day is not exceeded, no identification is necessary. This method was common in the crypto industry before KYC led to major changes from 2016. Only crypto veterans may remember this classic trading method.

To use Mt Pelerin’s offer, the Bridge Wallet must be downloaded. It is a non-custodial wallet. Purchases and sales of various cryptocurrencies can be processed with just a few clicks via the wallet.

The Bridge Wallet can be set up like a regular software wallet. It provides the user with a key phrase consisting of twelve words, through which they always retain control over the cryptocurrencies.

Buy Bitcoin now via Mt Pelerin

Which Cryptocurrencies Can You Buy without KYC?

In February 2023, the Bridge Wallet supports twelve blockchains. These include classics such as Bitcoin and Ethereum, but also fast and cost-effective scaling solutions such as Optimism, Arbitrum and Polygon. There are also Avalanche, BNB, Fantom, the Ethereum sidechain Gnosis Chain, the Bitcoin Layer-2 Rootstock (RSK) and Tezos.

Only BTC can be transferred via Bitcoin and Lightning. All other blockchains allow the sending of other digital assets. Above all, stablecoins that map the US dollar, the Swiss franc and the euro are supported.

Mt Pelerin Integrates Lightning Network

Mt Pelerin recently expanded its offering to include the Lightning Network. Through the lightning-fast transactions of the P2P network, they want to offer customers even more convenience and promote the role of cryptocurrencies as a means of payment.

In the future, Mt Pelerin customers should be able to operate their own Lightning Node via the Bridge Wallet. By default, the financial institution based in Neuchatel takes on the role of a custodian. Anyone who already operates their own network node can use it via Bridge Wallet.

Buying Cryptocurrencies without KYC via Mt Pelerin – is that Legal?

Mt Pelerin is one of several Swiss providers that allows its customers to buy cryptocurrencies without KYC. This option is based on the laws of the Swiss Confederation, which only require identification from a daily trading volume of CHF 1,000.

In CoinPro’s test, Mt Pelerin needed one working day to convert a bank transfer into cryptocurrencies. Since we did not exceed the annual volume of 499 francs, we actually received the deposited value in a ratio of 1:1.

The offer is accessible to people from 171 countries. The applications are already available in six languages. Among others, US Americans and Russian citizens are excluded from use.

Because of the low hurdles when buying crypto, the company uses the advertising slogan:

The easiest way to buy cryptocurrencies.

What Fees Does Mt Pelerin Charge?

According to Mt Pelerin, the trading fees are 0.9 to 1.3 percent. The percentage decreases with increasing trading volume. In addition, users can increase their free amount and reduce fees by purchasing Mt Pelerin Shares tokens.

Buyers of the MPS token become shareholders of the financial company. They receive a digital voting right as well as dividends paid out for their share. There are also normal shares with ISIN. Tokens and shares can be converted into each other.

A bank transfer from Switzerland or a SEPA transfer from the EU are free of charge. SWIFT transfers are only subject to the fees charged by SWIFT. Furthermore, Mt Pelerin covers all network fees apart from Ethereum.

What Makes Mt Pelerin Special?

The strength of the Swiss financial service provider is the waiver of KYC measures. A large proportion of users should be completely satisfied with CHF 1,000 per day. KYC and AML have long been a nuisance in the crypto scene. Various examples prove: That’s not without reason. In 2022, hundreds of thousands of user data from Celsius became public.

However, Mt Pelerin is also promising for other reasons. The functioning of crypto trading prevents the long-term custody of customer deposits. This is still common on the largest trading platforms in the industry and led to the disaster surrounding FTX.

It was for this reason that the DeFi platform ShapeShift integrated the Swiss provider. ShapeShift founder Erik Voorhees is an avowed opponent of KYC. His platform allows the exchange and trading of cryptocurrencies without third-party custody and state supervision.

For this goal, Mt Pelerin is a suitable partner whose name is not only coincidentally reminiscent of the Mont Pèlerin Society. They feel committed to the freedom of their users. According to their own statements, the company is already working on further digital infrastructure.

“Mt Pelerin is also planning to work on payment solutions for merchants in order to contribute to the growth of the Bitcoin ecosystem.”

Was recently announced in a press release.