We have already dealt extensively with the question of what influence psychology can have on trading cryptocurrencies and other assets. Traders are well advised not to attach too much importance to gut feeling. Nevertheless, emotions cannot be completely excluded in everyday life. Many indicators and instruments have emerged in the market in connection with emotion-related decisions. They can become an important tool in trading. One “tool” is the so-called Fear and Greed Index. In the following, we would like to deal with the index, its function and its significance.

The Current Bitcoin Fear & Greed Index

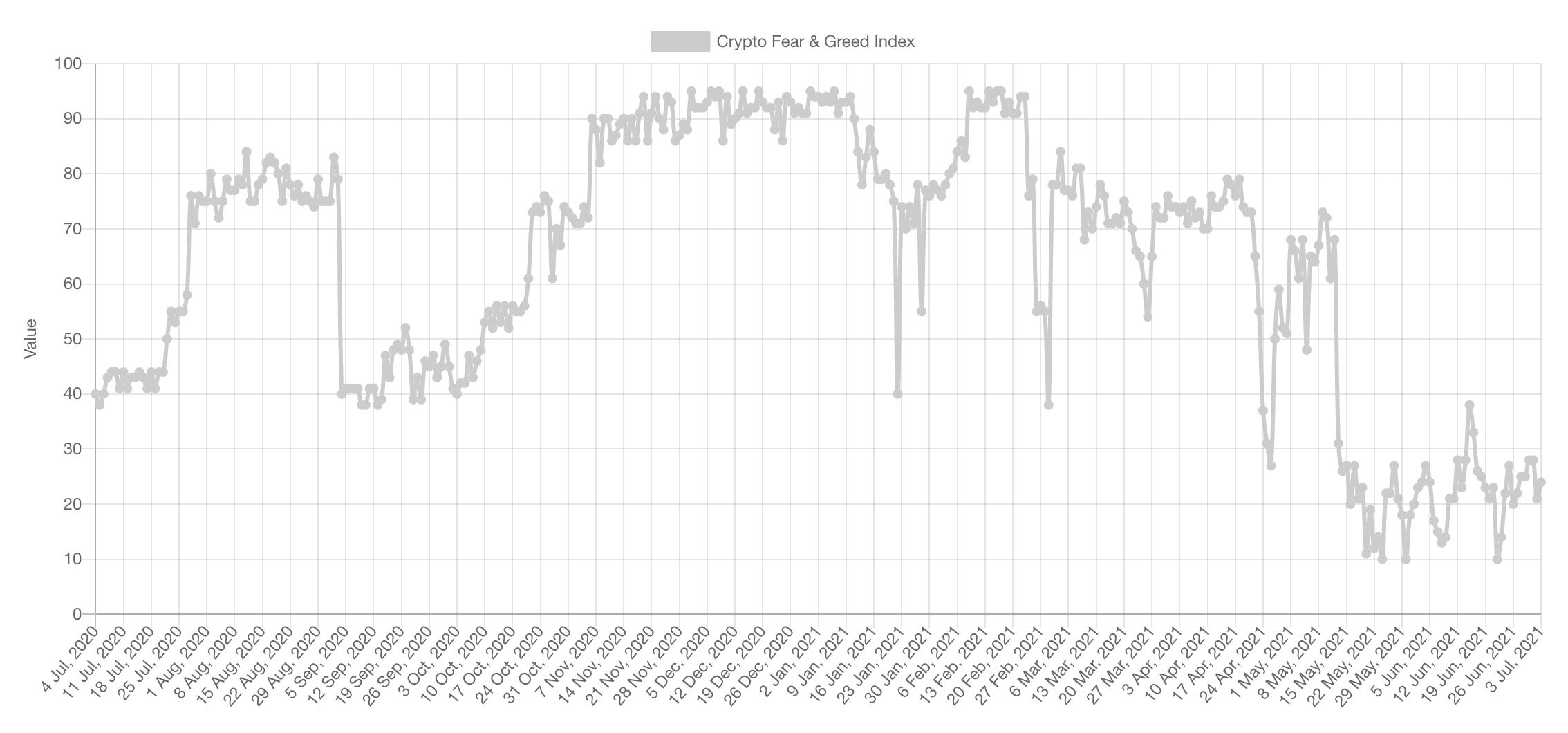

If you want to view the current Fear & Greed Index, you will find the value in this section. Afterwards, we will give you an explanation of what the value says and how you can interpret it.

What is the Fear and Greed Index and What is the Background?

The index name says it all. It contrasts investor and investor fear – referred to as fear – with greed and establishes a relationship between the two criteria. The psychology of market participants makes it possible in many phases to draw conclusions about price movements. A popular example for trader decisions is the “fear of missing out” effect, or FOMO for short. It is about the concern of missing opportunities, which in turn can lead to a kind of short-circuit reaction among investors. This effect becomes particularly clear when the market shows extremely strong price fluctuations. The Fear and Greed Index developed by CNNMOney has long been established on the stock market. A further development for the crypto space was a logical step. The index can be classified as a measure for determining market sentiment to sentiment analysis.

The Best Crypto Exchanges!

The best crypto exchanges compared:

- Safety

- User-friendliness

- Fees

- Deposit and withdrawal methods

- Trading offer

The basis is several aspects, which in turn have different weights in the indicator. The success of this analysis approach stands and falls with the underlying data quality. The result of the calculation is a value in the range of 0 and 100. This is what the values of the Bitcoin Fear & Greed Index say:

- A value of 50 has a neutral status;

- a value below 50 stands for rather anxious,

- a value between 50 and 100 for rather “greedy” moods.

Like any analysis tool, the Fear and Greed Index is prone to errors, which can affect the validity. The consequence: Anyone who relies on the index can make loss-making wrong decisions assuming incorrect analysis data. But wherever there is shadow, there is also proverbial light. In short: The Fear and Greed Index can allow conclusions about an uncertain market sentiment and opportunities. But the Fear and Greed Index is of course also not an indicator that a crypto forecast will definitely come true.

| Some analysts put it in a nutshell:

→ If there is fear in the market, this can speak for a purchase, while a high “greed value” can rather have a signal effect for sales. If other market participants act out of fear, greedy decisions can pay off, while anxious behavior may be advisable depending on the situation, should the majority of participants proceed particularly greedily. |

The billionaire investor Warren Buffet is considered a well-known representative of this practice. A key pivot point for the said sentiment analysis are leading large trading venues and exchanges. For the simple reason that serious trends and price movements are usually recognizable here in the first step. Other stock exchange providers and market participants make these developments the basis, for example, in internal analyses (also for the order books of their clientele).

This is how the Bitcoin (BTC) Fear and Greed Index Works

The index does not necessarily have to come from external sources as a trading foundation. Traders can become active themselves. The appropriate application of reliable data is then all the more important. In addition, it takes a healthy basic knowledge to be able to correctly assess developments in the market and investor decisions. Furthermore, users must correctly weight the various index criteria. Let’s take a look at the index rating of the platform Alternative.me involved in the Bitcoin-related further development of the Fear and Greed Index. Here, six characteristics with different characteristics play a role. Alphatically, these are:

The Dominance as an Index Factor

Alternative.me assigns this value a share of ten percent. The dominance of a cryptocurrency indicates what share it has in the capitalization on the overall market. The Bitcoin dominance is particularly high, but it fluctuates sometimes significantly. A very high dominance value speaks for portfolio reallocations of many crypto investors away from altcoins and towards BTC. Like gold on the classic market, the first cryptocurrency in the world is considered a safe investment in critical market phases. However: The factor does not have to stand exclusively for uncertainty. High Bitcoin investments can also give indications of safe market situations. In this respect, the significance is sometimes difficult to assess.

The Factors Market Volume and Momentum

The share of both factors is 25 percent in the example mentioned. A high market volume is a signal for a lively market participation of many traders. The volume is considered one of the central indicators. The basis of calculation of the factor: The current market volume is set in relation to the average volume of the past 30 days (or 90 days). The “greed factor” is particularly high in the case of a high volume of purchase transactions in the environment of a positive market. Another calculation approach for determining the market volume is the put-call ratio used in many markets. The number of all put or short positions (sales) is divided by the number of call or long positions (purchases) at a time x. The dominance is on the side of the put options for values from one upwards. This indicates that the mass of market participants assumes falling prices and classifies the mood as rather negative.

The Factor Social Media

Social media have a high priority, especially in digital commerce. Here, users worldwide discuss cryptocurrencies about current prices, news and rumors. Crypto heavyweights like Elon Musk regularly send courses on mountain and valley trips with Twitter posts. The Dogecoin, but also the Bitcoin are two examples of such developments. Based on the use of the hashtag use, quite accurate sentiment analyses can now be developed. In our example, it is about the speed, quantity and frequency of Bitcoin-related hashtags that are published and commented via social media.

The greed factor is high if many requests circulate in the highly frequented portals and a large thematic interest is recognizable. Also targeted price manipulations through approaches “Pump and Dump” were repeatedly recognizable in the past. Social media are taken into account in the Fear and Greed Index of Alternative.me with a share of 15 percent.

The Trend Factor

The view into current Google Trends developments flows into the analysis with a share of ten percent in the considered Fear and Greed Index. The results of the leading search engine are analyzed with regard to certain search terms in the crypto context. At this point regarding the Bitcoins. An increasing Bitcoin interest is automatically reflected in an increase in the requests in the search engine. In the past years, there were several cases in which the Google requests increased rapidly parallel to the massive BTC increase.

The Factor Surveys

The index assigns this aspect a share of 15 percent. It goes without saying that many participants allow better analyses than surveys with manageable large groups of participants. The more traders or interested parties get involved, the better and more precise the mood can be determined and a forecast can be formulated. However, the question arises about the honesty of statements. In addition, surveys are susceptible to manipulation. Originators can consciously influence analyses – for example, via the question or the selection of participants. Also the use of special programs can promote a “fake” influence at this point of the Fear and Greed Index. “Purchased” statements are another risk. However, this category is temporarily not included in the Bitcoin Fear & Greed Index.

The Factor Volatility

Like market volume and momentum, the share of the volatility factor in the Fear and Greed Index is 25 percent. The more stable the Bitcoin price, the safer market participants feel. If the fluctuation range (volatility) of the course, however, turns out to be very high and the currency often and significantly changes its course, one assumes a comparatively anxious Bitcoin market. In the case of the Fear and Greed Index, the current volatility is compared with the average of the past 30 or 90 days. If a rather atypical – for example, particularly serious – fluctuation range emerges, the influence on the course of the/a cryptocurrency is large. The consequence can be veritable chain reactions due to acute trader decisions.

Technical Instead of Sentiment Analysis as Index Basis

As already mentioned, there are now various providers on the market that offer their own Fear and Greed Index. This has also led to the emergence of models that do not exclusively refer to sentiment analysis. The well-known platform Tradingview is a service provider that determines the index on the basis of data from technical analysis. The starting point is accordingly indicators of technical analysis. Here, too, there are various factors that are often used for the evaluation of signals for purchases and sales.

These are, among others, depending on the provider:

- moving averages

- Pivot (-points)

- oscillators

Advantageous here can be that many Fear and Greed Index variants are available for free. In addition, users have the possibility to use them based on individual time intervals. In addition, users have the chance to set individual indicators as a central analysis perspective in order to get indications of a good time for a purchase or sale. The decisive factor for trading decisions should ideally be a selection of several indicators. The more indicators are used, the more likely it is to derive probabilities for price developments. Once again, the more extensive expertise leads to reliable analyses. An own assessment based on experience is generally better than relying solely on the expectations of others.

| Wert | Farbe | Sentiment |

|---|---|---|

| 0-35 | Dunkelrot bis rot | Furcht (fear) |

| 36-70 | Orange bis gelb | Neutral (neutral) |

| 71-100 | Gelb bis grün | Gier (greed) |

Our Conclusion on the Fear and Greed Index

Like any analysis tool, the Fear and Greed Index is particularly effective when it is used as part of an overarching assessment of the market situation. The price of Bitcoins and other currencies such as Ethereum or Ripple always depends on different criteria. Traders should therefore be as broadly positioned in analyses. As part of the sentiment analysis, the Fear and Greed Index is suitable, for example, when users also take into account many data from technical or fundamental analysis in parallel. Not to be forgotten: General market news and the diversification of the portfolio also decide on success and failure in trading cryptocurrencies.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch