What is Cardano and how Does it Work? – Basics for Beginners

Cardano is a blockchain and cryptocurrency that has been among the top ranks of the crypto market since its inception, although its development is progressing very slowly. At the same time, the project still meets with a lot of rejection in the crypto scene. CoinPro tells you why supporters have so much hope in ADA.

Trade Bitvavo now at Bitvavo:

European exchange with EU license (MiCA)

over 180 cryptocurrencies

10 Euro sign-up bonus

- Deposit via PayPal

- Staking available

- low fees

Cardano Explained: the Basics

Cardano was first announced as a smart contract platform in 2015, finally launched in 2017 and has only had a smart contract functionality since September 27, 2021. The project focuses on the DeFi area. Cardano wants to solve problems that were identified in the pioneer Ethereum.

What is Cardano?

Cardano is a blockchain that serves as a smart contract platform. This puts the project in direct competition with Ethereum. The goal is to serve as a basis for decentralized applications. This requires a smart contract functionality.

The creators like to call the project the “third generation blockchain.” It is said to be particularly professionally developed and innovative. This puts it directly above Bitcoin and Ethereum, which are considered the first and second generation.

It is open source software. Two central companies are behind Cardano: On the one hand, Input Output Global (formerly Input Output Hong Kong). This is responsible for a large part of the development work. However, due to the open source nature, any person can volunteer.

On the other hand, there is the company Emurgo. It develops solutions for business customers and is responsible for marketing. Both companies are profit-oriented. In 2023, 400 people are employed by IOG, and over 40 people belong to Emurgo.

The Cardano Foundation, based in Zug, employs over 130 people and administers the development of the project. The blockchain is based on a Proof of Stake consensus mechanism called Ouroboros.

Who Invented Cardano?

Cardano is an invention of Ethereum co-founder Charles Hoskinson. The US programmer wanted to turn ETH into a profit-oriented company that collects investments from donors such as venture capital firms. Ethereum initiator Vitalik Buterin strictly rejected this idea.

In 2014, just months after work on Ethereum began in 2013, Hoskinson left the ETH team again. Afterwards, he was deeply frustrated that no consensus had been reached. His colleague Jeremy Wood was able to motivate Hoskinson in the same year to start working on a new, own project.

The two developers founded the studio Input Output. Hoskinson began developing the project in 2015. The full publication followed in 2017.

What is ADA?

ADA is the native cryptocurrency of the Cardano blockchain and its abbreviation (ticker). It is often also referred to synonymously as Cardano. Since it works according to the principle of Proof of Stake, the maximum supply of 45 billion ADA was already created in the Genesis Block.

However, the circulating supply is lower. In January 2023, it is 34.5 billion. The remaining coins will be distributed to stakers over many years. Cardano’s circulating supply is expected to reach its peak in over 100 years.

At an ICO from September 2015 to December 2016, the responsible company Attain sold 57.6 percent of the maximum supply – almost 26 billion ADA. By the end of the sale, $62.2 million was raised.

Since the payment was made in Bitcoin, a sum of 108,844.5 BTC came together. Around 8,200 BTC of this went to the Cardano Foundation, while the rest went to IOG and Emurgo.

The Cardano Genesis Block also distributed 648 million coins to the Cardano Foundation. Another two billion ADA went to Emurgo and almost 2.5 billion to Input Output. Summed up, almost 5.2 billion ADA.

According to the Cardano Foundation, part of ADA flows from a reserve to the Cardano Treasury (also called Pot) every year. In January 2023, there are 9.6 billion coins in the reserve. These are the last coins that are not yet in circulation.

How Does Cardano Work? Use Cases of ADA

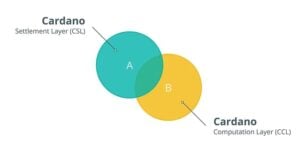

How does Cardano work and what are the use cases for ADA? In fact, since its launch, the cryptocurrency has been taking a different path than the pioneers Bitcoin and Ethereum. The ADA blockchain is based on a structure that consists of two different layers – it is called CSL and CCL.

CSL stands for Cardano Settlement Layer. This layer processes all payments. CCL stands for Cardano Computation Layer. It executes the Smart Contracts. The developers want to keep the latter layer particularly dynamic and flexible. This should allow for the creation of the widest possible range of dApps.

Another technical feature distinguishes ADA. The blockchain divides funds into UTXOs and thereby remains true to the example of Bitcoin. However, since these caused problems in the realization of scripts, Ethereum discarded the UTXOs and instead uses a classic account model.

This in turn is considered more susceptible to double spending. With the Extended UTXOs, Cardano created a principle that is based on the template of Bitcoin, but can still process smart contracts.

Smart Contracts and the Cardano Blockchain

As a DeFi blockchain, Cardano naturally needs smart contracts. Without these, no dApps can be built. Although ADA was already released in 2017, the programming level called Plutus was only launched on September 12, 2021.

Plutus is not only the name of the EVM equivalent, but also refers to the programming language used for the scripts.

What are Cardano dApps?

“Cardano dApps” stands for decentralized applications on Cardano. These are websites whose underlying protocols function decentrally via the ADA blockchain.

For the ecosystem of a smart contract platform, dApps are of crucial importance. According to DefiLlama, the DEX Minswap is the most important dApp on ADA in January 2023.

Comparable blockchains in Web3 have been significantly more successful than ADA up to this point. At the moment, ADA is only in 28th place in terms of locked-in money (TVL).

What Can Cardano be Used for? – Possible Use Cases

Of course, ADA, like Bitcoin, can be used as a trustless means of payment. With a throughput of currently 250 transactions per second, ADA even fulfills this task relatively quickly and inexpensively.

The main goal of the blockchain is the construction of Web3. Decentralized applications should be built on ADA. Many different crypto projects compete in this field. However, Cardano is considered one of the most promising platforms. Over the past few years, it has earned a reputation as reliable and stable. At the same time, users often complain about slow development.

Cardano Staking

Cardano staking enables ADA holders to have a completely passive income of up to 4.6 percent per year. Anyone who invests their ADA in staking must wait until the start of the next epoch for the amount to flow into the staking pool. With ADA, an epoch lasts five days. Users can therefore invest their cryptocurrency profitably within a short period of time.

ADA offers users an easy way to operate their own staking pool. All it takes is your own network node that has reliable online times and the technical skills to manage the node.

Unlike Ethereum, a minimum deposit of coins is not necessary here. Consequently, ineffective or malicious validators face no slashing. The developers themselves believe that slashing on ADA is not necessary because the decentralization of the network through the simple provision of staking is so enormous that an attack is not profitable and an ineffective validator is simply irrelevant. It says:

In addition, the Cardano ecosystem is very inclusive and the delegators have control over their coins and can change their decisions regarding delegation inexpensively.

In addition, there is no lock-up period when staking ADA. Anyone who wants to stop staking can do so immediately and immediately receives access to their own investments.

According to Adapools, around 902,000 wallets invested 25 billion ADA in staking in January 2023. This corresponds to 72 percent of the circulating supply. With over 3,200 staking pools, the decentralization strategy is quite effective.

What is a Cardano Era? What Does the Roadmap Say?

ADA divides its development into five different segments. These are called Era. In each of these sections, the responsible programmers focus on specific elements.

The Cardano Roadmap includes the eras Byron (technical basics), Shelley (decentralization), Goguen (smart contracts), Basho (scaling) and Voltaire (administration). Each era of the roadmap is named after an intellectual personality.

Currently (as of January 2023), ADA is in the penultimate phase, Basho. At the end of this development section, the blockchain should be able to process up to 100,000 transactions per second.

The Future of Cardano: Forecast for the further ADA Course

It is not without reason that Cardano has been able to consistently remain among the ten largest cryptocurrencies over the past few years. The hope for the project is huge among many investors. This is mainly due to the reputation of crypto veteran and founder Charles Hoskinson.

Many users respect ADA for its reliability. The developers attach great importance to quality and take the time they need for their work. Among the DeFi blockchains, the project may therefore continue to hold one of the top ranks in the future.

Analysts believe that ADA could be one of Ethereum’s toughest competitors in the fight for supremacy in Web3. Critics emphasize that Cardano has not yet succeeded in conquering a significant part of the DeFi market.

How Can I Buy Cardano?

Since ADA is one of the largest cryptocurrencies, the coin can be purchased on almost every crypto exchange. CoinPro recommends, for example, the offers from Bitvavo and Binance. Both trading platforms are established on the market. Users can deposit their fiat currencies there and only have to pay very low fees for the purchase of the cryptocurrency.

Trade Bitvavo now at Bitvavo:

European exchange with EU license (MiCA)

over 180 cryptocurrencies

10 Euro sign-up bonus

- Deposit via PayPal

- Staking available

- low fees

ADA is less popular on P2P marketplaces. A simple crypto-to-crypto trade is possible on many swappers. Newcomers can use CoinPro’s instructions: Buy Cardano.