Donald Trump threatens China with enormous import tariffs. The crypto market reacts with a flash crash. Although no political solution is yet in sight, the crypto market is already recovering. CoinPro explains why this is the case.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. Limited time offer: €20 bonus when you sign up via CoinPro.ch

Crypto Market Recovers after Historic Crash

The crypto market is currently recovering after a crash of historic proportions. On Friday, the Bitcoin price experienced a flash crash down to 104,953 US dollars. Shortly before, it had been at 117,000 US dollars. Within two hours, BTC lost more than ten percent of its market value.

- Bitcoin

(BTC) - Price $66,750.00

- Market Cap

$1.33 T

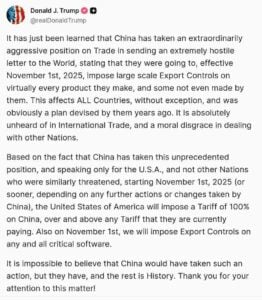

Behind the enormous price drop was once again US President Donald Trump. He announced that Chinese goods would be subject to 100 percent import tariffs. Trump thus made it clear that there is still no consensus with the Asian nation. Measured by the liquidated options markets, it was, in absolute terms, the largest crypto crash of all time. Within one day, more than 19 billion US dollars were liquidated.

You are currently seeing a placeholder content of X. To access the actual content, click on the button below. Please note that data will be passed on to third-party providers.

In August, China and the USA had last reached a preliminary solution. This eliminated exorbitantly high tariffs between 125 and 145 percent. Instead, the two states mutually applied tariffs of ten to 30 percent on their exports. They wanted to find a permanent solution by November 10, but the negotiations failed.

In a post on Truth Social, Trump threatened an additional 100 percent fee, as China plans to implement an aggressive trade strategy internationally. The new import tariff is therefore merely a reaction to the Chinese endeavor. It is scheduled to take effect on November 1.

The US President’s announcement dealt an enormous blow directly to the entire crypto market. Besides Bitcoin, almost all cryptos lost massive value. The crash is still visible for many coins in the weekly trend.

BTC is still down 7.55%. Ethereum has dropped by 9.72% so far. Many other coins – such as XRP, Solana, or Dogecoin – slid even further with losses of 13 to 20 percent.

These are the Reasons for the Crypto Recovery

If one looks at the daily trend, however, mostly green figures are already emerging. Since its regional low of around 105,000 US dollars, Bitcoin rose by about 8.60%. At the time of editorial deadline, it stands at 114,273 US dollars.

Most other cryptocurrencies also achieved similar developments. The entire market rose by 4.66% over the last 24 hours. The 100 largest cryptos gained 4.43%.

But why is a crypto recovery already happening now? Trump did not retract his threats. The Chinese government accused the US of double standards and warned that similarly high import tariffs would also be applied to imports from the US.

The fundamentally bullish conditions that already exist for crypto or are currently emerging do not change because of this. Furthermore, investors usually leave the crypto market during such a critical market situation to invest in investment products with higher security – such as US government bonds.

Because a strong devaluation of the US dollar and a simultaneous decrease in interest rates on US government bonds are expected under Trump, many crypto investors simply bought more, while another part left the market.

Crypto is becoming increasingly popular as a refuge when political friction arises. Market analysts like Arthur Hayes believe that fiat currencies will lose massive ground against crypto over the next months and years. Leaving the market now would therefore not be a profitable decision.

The depreciation of many coins was thus stopped prematurely. Since yesterday, the CMC Fear & Greed Index therefore rose from 31 to 40 points. Crypto is therefore no longer in a fearful market situation. Instead, the sentiment is now neutral again.

Buy Bitcoin now!