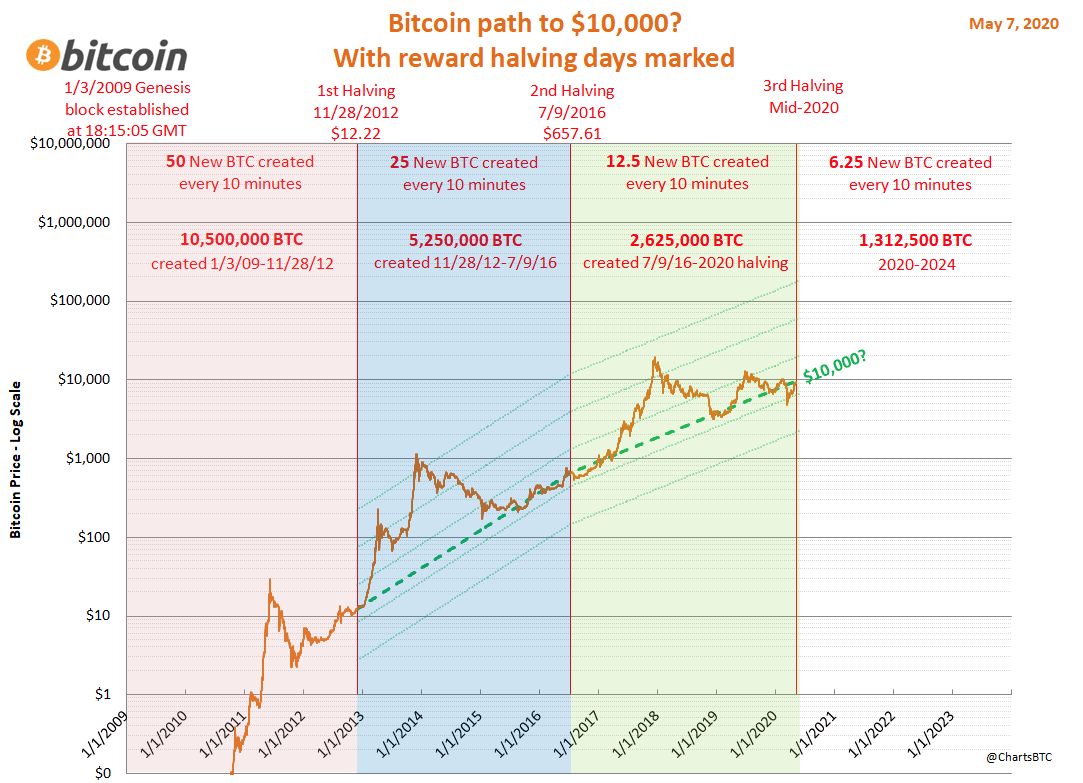

Even though there is still some time until the next so-called Bitcoin Halving (halving), experts are already saying that the upcoming halving in 2024 will have a positive impact on the price. But what exactly is Bitcoin Halving? Basically, it is a very important feature that Satoshi Nakamoto came up with during the early programming of the digital currency. The reward per mined (minted) block is halved. In combination with the fact that the number of Bitcoins is limited to 21 million coins, prices could rise as (increasing?) demand meets a limited supply. This is because it becomes more difficult to calculate the numerical sequences and more computing capacity is required. And this capacity costs money. “Previously”, several Bitcoins per day could be calculated on a home PC. Nowadays, this would take years for the same number of Bitcoins.

The Bitcoin Halving Reduces the Supply

As a result of this limited availability and increasing demand with growing awareness, the value of a Bitcoin increases. Now comes the so-called halving. This is stored in the code of every BTC.

Specifically, this means that every 210,000 blocks or approximately every 4 years, miners receive only half the amount of Bitcoins as compensation (so-called rewards) for their mining work. Until 2012, miners received 50 BTC per block, after November 28, 2012, it was only 25. Since July 2016, i.e. another 210,000 blocks later, it is only 12.5 BTC per block. On May 11, 2020, the miners’ rewards were reduced to 6.25 BTC.

Historical Data on Previous Halvings

- Genesis Block: January 03, 2009

- first Bitcoin Halving: November 28, 2012

- second Bitcoin Halving: July 09, 2016

- third Bitcoin Halving: May 11, 2020

- fourth Bitcoin: approx. May 2024 (exact timing)

The Upcoming Bitcoin Halving

The next halving is scheduled for May 2024. The rewards for miners will be halved again from 6.25 BTC to 3.125 BTC. And there are divided opinions in the community and among experts as to how this will affect the Bitcoin price. On the one hand, there are the optimists who predict a surge in prices. Since they continue to expect increasing awareness and thus increasing demand, this must have an impact on the price, as the supply can no longer increase. On the other hand, experts see it as price neutral. This includes Mao Shixing, co-founder and CEO of the world’s sixth-largest mining pool, F2Pool. In an interview with Jinse Finance, he said that investment income from mining rigs could be offset over time by various household appliances. The use of such devices would lead to a drastic increase in Bitcoin miners, causing the Bitcoin ecosystem to grow explosively.

However it may come, a halving is always a special moment in the Bitcoin world.

Want to get started with cryptocurrencies and Bitcoin? No problem with the CoinPro.ch Shopping Guide.

More terms related to Bitcoin and other digital currencies in our A-Z list.

The CoinPro.Ch Provider Test – the Best Options for Buying, Trading and Trading Bitcoin

Provider

Result

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: 10 Euro bonus when you sign up via CoinPro.ch

Trade many different cryptocurrencies without a wallet with our CFD broker test winner Plus500 - 7 days a week.

Regulated provider from Austria - specializing in trading Bitcoin, Ethereum, stocks and many other assets.

CFDs and real stocks in a trading platform with free deposits and no conditions - that's XTB.

OKX is one of the largest crypto exchanges in the world and combines numerous functions such as a wallet, staking, futures, margin, and spot trading in a single platform.

With several hundred thousand customers worldwide, Binance is one of the top 10 largest and most well-known exchanges. The use of the exchange is free of charge, with fees only applying to the purchase and exchange of cryptocurrencies.

CFDs are complex instruments and, due to leverage, carry the high risk of losing money quickly. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.