What’s next for Bitcoin and the crypto market in 2024? CoinPro reveals why a huge bull market awaits us. A whole range of topics could dominate the coming months. New regulatory requirements will increase the conflict between crypto and authorities in one of the most important political areas on earth.

Bitcoin and Crypto in 2024: What Awaits Us?

How will Bitcoin and the crypto market develop in 2024? Some big events are coming up for the scene. In addition, some trends are emerging that could intensify or lose their previous importance in the coming year. CoinPro takes a look at the most promising topics.

Bitcoin Rally in 2024: New Bull Market Very Likely

A Bitcoin rally awaits us in 2024. A new bull market is very likely. Several upcoming events support a strong upward trend. As early as the beginning of January, there could be massive price gains for BTC and Co. if the US Bitcoin Spot ETFs are approved as expected.

Hopes for exchange-traded funds are now huge in the crypto market. The world’s largest asset manager, BlackRock, registered a Bitcoin Spot ETF in June, citing enormous institutional interest in Bitcoin as the reason for this step.

Crypto investors assume that many billions of US dollars will flow into Bitcoin, which have not yet been able to find an adequate entry point.

In addition, the next Bitcoin halving will follow in April. The halving of the block reward usually triggers a bull market, as market data proves. Many well-known analysts and industry figures expect strong gains – even beyond the 100,000 US dollar mark, which has never been broken before.

As early as 2022, crypto entrepreneur Jesse Powell predicted that Bitcoin would jump above $100,000 in 2024. Analysts at CryptoQuant were even more explicit. In 2024, three price targets are of interest for Bitcoin: the low $50,000 mark, which could form a new floor.

In addition, the price of $54,000 forms an average value. BTC is predicted to have a peak value of 160,000 US dollars. Measured against the current price of 43,000 US dollars, this corresponds to a growth of 270 percent.

Nevertheless, some analysts are predicting a declining Bitcoin dominance for the spring of 2024. An altcoin season should then begin.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

Crypto Industry Working on Higher Security

Due to the way cryptocurrencies work, modern means of payment are still considered a niche product by some critics. The crypto industry wants to change this. There have been advances in this area, especially from Ethereum.

Ethereum has been working for some time on the so-called account abstraction, which is intended to increase the ease of use and security for the owners of a wallet by merging the two existing account types that ETH currently allows.

In addition, Ledger wants to positively influence existing standards. Ledger is currently the largest manufacturer of hardware wallets. After a scandalous attack on an online interface of the company, which caused six-figure damage in mid-December, Ledger promised improvement.

The previous standard of blind signing should no longer be used in the future – at least on Ledger devices. Instead, clear signing should be used. This gives users better insights into transaction data so that they can see exactly where they are sending their cryptocurrencies.

Privacy and Neutrality of the Blockchain are once Again a Topic

The privacy and neutrality of blockchains are once again a topic. As time goes on, government intervention in the crypto world is increasing. In order to still achieve the great goal of freedom, the privacy and neutrality of cryptocurrencies should increase – at least that’s what Ethereum inventor Vitalik Buterin demanded in his vision for the coming months.

So that Bitcoin and Co. can remain neutral, they must not fall under state control. Since the US authorities filed a lawsuit against the Ethereum mixer Tornado Cash, this issue has repeatedly been a topic of discussion.

Buterin is calling for a departure from greed. Price charts and profits should no longer be the focus. Instead, the scene should return to its original values: neutrality, censorship resistance and openness.

The Canadian programmer also wants to promote rollup systems, which increase the throughput of Ethereum. In general, trends show that mass suitability is an increasingly important point for investors, which plays an increasingly dominant role.

Decentralized trading platforms are likely to gain further momentum due to regulatory interventions and conflicts. Most recently, THORChain in particular benefited strongly. It is currently the most capable decentralized protocol that allows cross-blockchain trading.

There is also a lot of hope for atomic swaps, which already exist in initial versions, but have so far had problems with technical implementation.

Encrypted Blockchains Growing Point of Contention

Buterin is not the only person who places a focus on privacy. Encrypted blockchains have become a growing point of contention over the last few months. In the EU, the trading of privacy coins on centralized crypto exchanges is prohibited from 2024.

In the crypto scene, the system of homomorphic encryption came into discussion, especially in late 2023. This allows unknown data to be processed in its encrypted form – this concept is particularly interesting for smart contracts.

Homomorphic encryption (short FHE) is considered a better alternative to zero knowledge proofs in some cases, which have so far been considered the most potent solution, although both systems do not fulfill the exact same functions.

Optimists expect that blockchains and cryptocurrencies will become more attractive to companies through homomorphic encryption, as sensitive data can remain secret.

The Aztec Network and Fhenix want to provide FHE for Ethereum, while the Mind Network wants to support BNB and Chainlink in addition to ETH. Dero is working on an independent system.

The technical feasibility of FHE is a big question mark. To what extent encryption will play a role in 2024 therefore remains questionable.

Ethereum Alternatives are Flourishing

Ethereum alternatives are flourishing more and more often. Solana, Cardano, Avalanche and Polkadot in particular recorded massive gains towards the end of the year. Solana experienced great institutional interest throughout 2023.

This trend is likely to continue in 2024. Investors are looking for blockchains that are already suitable for mass use due to their technological properties. Ethereum wants to introduce sharding in 2024 in order to be able to keep up with its competitors in terms of scalability. The throughput of the Ethereum mainnet is very low compared to newer projects.

Bitcoin at a Crossroads in DeFi

Bitcoin is currently at a crossroads. The fronts of the Bitcoiners are hardening, especially in a debate about advanced functions. The trigger is the Ordinals protocol, which has made Bitcoin the most popular blockchain for NFTs since November.

It remains questionable whether the blockchain will continue to play a decisive role in this field. The NFT market is usually exposed to extreme volatility and already experienced a severe crash in 2022.

Bitcoin’s de facto NFTs, which are actually called Inscriptions, only have rudimentary functions and, unlike Ethereum’s non-fungible tokens, cannot be used in smart contracts.

In addition, several Bitcoin developers are calling for a change to the Bitcoin code to completely remove Ordinals. Among many users and investors, Ordinals are causing a strong bullish mood. The use of the Bitcoin network increased sharply due to Inscriptions and BRC-20 tokens, which are based on Ordinals.

Layer-2 solutions that equip Bitcoin with additional functions have recently received a lot of attention – such as Stacks (STX) or the Taro Protocol. The aim of both solutions is to enable Bitcoin to play a role in DeFi.

Controversial Crypto Law MiCA Comes into Force in 2024

The EU’s controversial crypto law, MiCA (also MiCAR), is expected to come into force on December 30, 2024. The law mainly deals with regulations for issuers of cryptocurrencies and stablecoins.

Both are subject to strict regulations. On the one hand, end users should be able to see in advance which functions and implications the acquired cryptocurrencies have. On the other hand, the EU wants to prevent the increasing popularization of the US dollar, which plays a significantly greater role in the crypto world in the form of stablecoins than the euro.

Parallel to MiCA, the EU adapted the Money Transfer Regulation (TFR) specifically for cryptocurrencies. The adaptation obliges crypto service providers to collect data about the recipients of a transaction in order to facilitate the identification of people behind blockchain addresses. Names and addresses should be saved.

In Germany, a comparable law – the Cryptocurrency Transfer Ordinance – has already been in force since September 2021. Apparently, the law is only applied sparingly or not at all due to poor practical feasibility. To this day, it is unclear how exactly service providers should determine the authenticity of the data provided by users.

MiCA and TFR could cause price changes, especially for privacy coins, through a ban. Value losses are to be expected in the short to medium term, while the trading value may even increase in the long term if the coins continue to be in demand due to their technical functions.

A similar price increase took place in Nigeria. There, the trading of cryptocurrencies was prohibited from 2021 until the ban was lifted a few days ago. During the ban phase, BTC was more expensive than in the rest of the world.

The regulatory status in the USA remains questionable. Despite several efforts, no crypto law has yet been passed. The next presidential elections will take place in the USA in November 2024, which could possibly replace the currently crypto-critical government.

Growth Potential in GameFi and AI

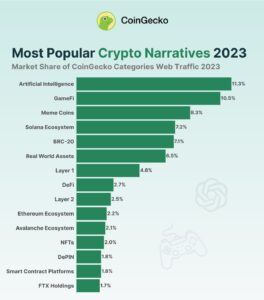

Growth potential apparently exists in the areas of GameFi and AI. According to CoinGecko’s records, artificial intelligence based on user searches was the most popular topic in the crypto market in 2023.

However, the category still lacks deeply rooted projects. The largest investments so far have been collected by Render (RNDR) and Fetch.ai (FET). The industry seems to be waiting for a promising project that develops an AI and is based on crypto at the same time.

The same applies to the GameFi category (also known as Web3-Gaming or Play to Earn). The most popular crypto games are Illuvium and Gods Unchained. The release of Shrapnel, Dead Drop and Off The Grid is expected in 2024. The games are expected to raise the previous level of blockchain games to a new high.