Third Generation Blockchains are now ubiquitous. Their potential is considered enormous. Some observers believe that they are driving the global spread of cryptocurrencies. Meanwhile, current data shows that they are also increasingly in demand as an investment. CoinPro takes a look at the purpose of the projects and introduces the best-known cryptocurrencies of this type.

Bitvavo, one of the leading exchanges from Europe (Netherlands) with a large selection of cryptocurrencies. PayPal deposit possible. For a limited time only: €26 bonus when you sign up via CoinPro.ch

What is a Third Generation Blockchain?

A Third Generation Blockchain sees itself as the next consistent section in the development of crypto-specific blockchains. Satoshi Nakamoto, the inventor of Bitcoin, is not considered the inventor of the blockchain, but Bitcoin is considered the first truly decentralized blockchain.

Bitcoin’s original goal is to serve humanity as a decentralized means of payment that is not subject to any particular institution. Therefore, the cryptocurrency should be neutral – i.e. equally available to everyone. Its use is possible globally. Bitcoin is referred to in this context as a first-generation blockchain.

After Bitcoin, Ethereum followed as the second-generation blockchain. Instead of just transferring values from A to B, Ethereum also provides an application layer that functions completely decentrally.

Since Ethereum, it has been possible to securely execute contracts on the Internet between two unidentified parties without an intermediary. The necessary element for this are Smart Contracts, which automatically execute a reaction after the success of an action. To this day, in 2024, this function is mainly used to lend money online.

Bitcoin and Ethereum both have a problem: In favor of their security and due to initially low demand, both blockchains are only slightly scalable. This makes transactions slow and expensive.

These Differences Exist between Bitcoin, Ethereum and Co.

Ethereum inventor Vitalik Buterin put forward the thesis in 2017 that the blockchain is in a trilemma. According to this, it can only adequately solve two of three decisive properties: decentralization, scalability and security.

Third-generation blockchains want to eliminate the disadvantages of their predecessors and solve the trilemma. Logically, they are therefore characterized by very high scalability. Within a very short time, they can process a massive number of transactions and thus offer their users significantly lower usage fees.

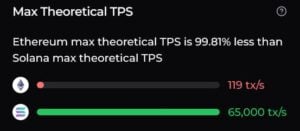

For comparison: While Bitcoin reached its previous limit at 13 transactions per second, Ethereum reached its limit at 62 TPS, Solana was already able to process 7,229 transactions per second.

Bitcoin even exceeded its often-cited theoretical maximum of seven TPS with this record value. According to calculations, Ethereum could process 119 payments – Solana’s theoretical maximum is even 65,000 TPS.

Which Third Generation Blockchains are there?

Among the 100 largest cryptocurrencies alone, a total of 20 projects are concerned with smart contracts. 19 of them want to offer a faster and cheaper alternative to the founder Ethereum.

The range of cryptocurrencies is enormous. Data aggregator CoinMarketCap lists a total of 2.4 million coins on December 19, 2024. Many of them want to represent a modern alternative to Bitcoin and Ethereum.

A third-generation blockchain is usually understood to be projects that combine the capabilities of Bitcoin and Ethereum with better scalability. As an additional function, they often choose interoperability with other independent blockchains.

Well-known examples of this modern blockchain generation are Solana, Avalanche, Polkadot, Sui, Aptos, Stellar or Near.

Whether a blockchain meets the necessary conditions to be considered the next generation of technology is debatable. The term “Third Generation Blockchain” is more of an advertising buzzword than a clear category anyway.

Cardano is an example of such a controversial project. Many experts rate the network as the third blockchain generation. Cardano’s developers do not use the term. A look at the scalability shows that it does not succeed in achieving a higher throughput than Ethereum during the current development stage.

Why are 3rd Gen Blockchains Important for the Crypto Market?

The new blockchain generation is considered an essential further development of the crypto market, as it could succeed in putting the high goal of mass adoption into practice. Bitbo suspects that 104 million people worldwide are already using Bitcoin.

However, only 400,000 unique users send their cryptocurrencies per day. If each of these people only carries out one transaction, the blockchain has already reached its limit.

According to Statista, the Visa network processed 720 million transactions per day in 2023. Bitcoin and Ethereum would be helplessly overwhelmed by this flood of payments. The network fees would rise immeasurably and many shipments would be delayed for months. The blockchains would be practically out of action.

If cryptocurrencies want to become a globally recognized, everyday phenomenon, their throughput must therefore increase sharply. Let’s stick with the example of Solana – this new blockchain managed to realize up to 65,000 transactions per second in tests.

5.6 billion money transfers could be successful via the network on the day. That still wouldn’t be enough to guarantee every person a daily shipment. The developers are therefore continuing to work on solutions to further increase throughput.

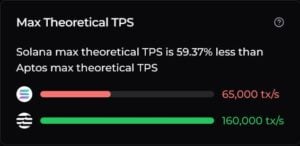

In 2022 and 2023, two further blockchains, Aptos and Sui, were launched, which were able to attract a lot of attention due to their enormous scalability. Aptos was able to process 160,000 transactions per second in tests, Sui even 297,000. The two cryptocurrencies are further developments of the stopped Facebook project Diem.

Do Bitcoin and Ethereum Make the Competition Obsolete?

Bitcoin and Ethereum are of course not standing idly by watching their competition. Both ecosystems rely on their own solutions to overcome the problem of low scalability. In this way, they want to assert themselves against Third Generation Blockchains.

So far, both originals have been relying on solutions that settle a large number of transactions outside the blockchain, summarize them and transfer them to the blockchain at a later point in time.

Bitcoin’s most popular scaling solution is the Lightning Network, which, however, repeatedly receives harsh criticism due to its own technical problems. An alternative under development bears the name Stacks.

Ethereum is currently relying on so-called rollups. L2Beat currently lists a total of 50 networks that make the smart contract platform’s work easier. In the future, Ethereum wants to introduce a function called sharding. This change would turn ETH into a network consisting of many interoperable blockchains.

That’s why BTC and ETH Remain Unchallenged Market Leaders so Far

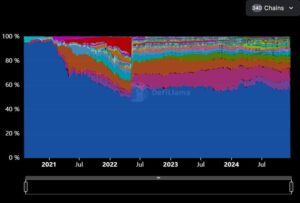

Despite the technical improvements with which the latest blockchain generation wants to convince, Bitcoin and Ethereum as long-established projects are still the market leaders.

Bitcoin can particularly rely on its good reputation. As the oldest and largest cryptocurrency, it is also often the very first cryptocurrency to receive support from new products.

BTC is the best-known blockchain, which is often regarded as a general representation of the entire crypto market. In addition, the attractiveness of the project increases with further growth through the much-cited network effect.

Ethereum has a similarly strong position. As the very first smart contract platform, the entry of interested parties seems logical at this point. Ethereum’s developers are very busy eliminating the technological shortcomings.

But ETH has a special support: the DeFi sector. There, the blockchain occupies a total of 58 percent of the market on December 21, 2024. Because the latest dApps often appear on Ethereum and the ecosystem is largest there, ETH remains the most interesting network for Web3 developers. As a result, it has the most liquidity.

The Best Crypto Exchanges!

The best crypto exchanges compared:

- Safety

- User-friendliness

- Fees

- Deposit and withdrawal methods

- Trading offer